Think about what would happen if a company were to find a cure for diabetes? This growing segment of the biotech sector has investors flocking to start-ups with promising treatments.

BIG NEWS 10.24.2019 Sernova (SVA) (SEOVF) Announces Biotech Veteran as New Chief Financial Officer

Sernova Corp’s (TSX:SVA) (OTC:SEOVF)’ Breakthrough Medical Device could Disrupt the Entire Biotech Industry

How Can One Small Biotech Stock Shake Up A Multi-Billion Dollar Market?

Nearly 100 years after the discovery of insulin, Sernova (TSX:SVA) (OTC:SEOVF) is advancing the treatment for type 1 diabetes. Its implantable Cell Pouch™ technology received FDA clearance and is currently intrials in the US. Sernova’s Cell Pouch™, combined with its immune protection technology, offers therapeutic cells local protection from immune system attack.

At a very basic level, this creates an effective, safe, long-term and convenient therapeutic option for patients with chronic disease. But this is no basic technology and it could set a stage to change the lives of millions of people dramatically.

Key Targets Could Suggest Major Disruption For Diabetes Treatment

To truly understand the market potential of Sernova (TSX:SVA) (OTC:SEOVF)’s regenerative medical technology here, we first need to understand that this is already a groundbreaking industry as it stands right now. Regenerative medicine is a next-generation branch of medicine, which broadly involves the development of technologies for replacing, engineering or regenerating cells, tissues or organs to bring back normal function of the body.

Sernova’s therapeutic approach to regenerative medicine focuses on providing direct cell therapies where the cells, transplanted within an organ-like vascularized implantable device, generates proteins, hormones or factors released into the bloodstream for treatment of diseases requiring replacement of these molecules in the body.

Imagine, one day, when diabetes patients no longer need to inject insulin or people affected by hemophilia no longer have to use needles to maintain some sort of normalcy in life. This is now reality and could be a critical point in time to be looking at Sernova (TSX:SVA) (OTC:SEOVF)!

The Cell Pouch™ is manufactured from medical-grade materials, previously approved by the FDA for permanent use in the body in other products. After receiving the sought after US FDA IND, the company has been rapidly pursuing human clinical trials with its Cell Pouch™ System in the United States!

Why is the IND so critical for a biotech company? The United States Food and Drug Administration’s Investigational New Drug (IND) program is how a pharmaceutical company obtains permission to start human clinical trials and to ship an experimental drug across state lines before a marketing application for the drug has been approved. Sernova (TSX:SVA) (OTC:SEOVF) has this!

It doesn’t just stop there either. The company also received University of Chicago Institutional Review Board approval for their FDA-cleared human clinical trial to investigate the Cell Pouch™ for treatment of type-1 diabetes in individuals with hypoglycemia unawareness. In line with this, Sernova (TSX:SVA) (OTC:SEOVF) has begun implanting its Cell Pouch ™ into patients for treatment of Hypoglycemia Unawareness and diabetes.

Sernova Corp Presents Positive Preliminary Safety and Efficacy Data in its Phase I/II Clinical Trial for Type-1 Diabetes

This was presented just a few months ago and could show exactly why Sernova (TSX:SVA) (OTC:SEOVF) has started generating more interest across the medical community and public market as well. Sernova (TSX:SVA) (OTC:SEOVF)’s Cell Pouch™ transplanted with islet cells showed initial safety, as well as key efficacy measures, including:

- Glucose stimulated C-peptide

- Insulin production

- Clinically significant measures of glucose control in the first study patient with type-1 diabetes and severe hypoglycemia unawareness.

There was specifically an 87.5% reduction in hypoglycemic events from baseline collected over a two-week monitoring period!

“These results are {…} a paradigm shift in the treatment of this debilitating disease. Our team is looking forward to reporting longer-term results in enrolled patients as the trial progresses.”

– Dr. Witkowski, principal study investigator

These data were so strongly delivered that it has firmly warranted advancing its clinical trials to more patients with type-1 diabetes. We aren’t talking about lab testing the technology on mice; we’re well-beyond that phase. Sernova’s Phase I/II clinical trials will be conducted on multiple human volunteers.

“The preliminary clinical data achieved in this patient with our pre-vascularized implanted Cell Pouch represent an early clinical validation for our regenerative medicine technologies as we pursue safe, efficacious, and transformative treatments for patients with hypoglycemia unawareness in type-1 diabetes.”

– Dr. Philip Toleikis, President and CEO of Sernova Corp.

Why Is Timing So Important Right Now?

Let’s get one thing straight, clinical trials take time but the closer it gets to a favorable outcome, the bigger the potential can be for a company. Furthermore, with each milestone can come even more attention to a company.

When it comes to the diabetes trials, Sernova (TSX:SVA) (OTC:SEOVF) has already shown favorable outcomes and now it’s time to scale the trial size to show it can be repeated multiple times with the same positive results.

The global diabetes therapeutics market was valued at $66.993 billion in 2016 and is estimated to reach $186.842 billion by 2023 [1]. This simple fact has created massive buzz across the biotechnology industry and further spurred a big buyout trend specifically for companies looking at diabetes treatments outside of the normal injection of insulin.

This wildfire of Big Pharma buying out clinical-stage companies could put a countdown on companies like Sernova (TSX:SVA) (OTC:SEOVF), and the proof is already showing to be in the billions:

Private Equity Firm Platinum Equity Buys LifeScan For $2.1 billion[2]

PHC Holdings Corporation Acquires Thermo Fisher’s Pathology Business For $1.14 Billion [3]

Novo Nordisk acquired diabetes company Ziylo for $800 million[4]

Vertex to Acquire Semma Therapeutics for $950 Million[5]

And it’s this most recent acquisition of Semma by Vertex that could be the writing on the wall for Sernova (TSX:SVA) (OTC:SEOVF). Semma Therapeutics is a privately held biotechnology company focusing on the use of stem cell-derived human islets as a potentially curative treatment for type 1 diabetes. But the most important part here is that Semma’s results have only been shown from proof-of-concept in animals.

Sernova (TSX:SVA) (OTC:SEOVF) is already in the clinic and on top of that, where Semma was valued at $950 billion in this deal, Sernova currently trades at a value of less than $40 million!

Analysts Are Bullish On Sernova (TSX:SVA) (OTC:SEOVF)

Besides it being ahead of the curve even compared to companies getting bought out for big money, analysts have become increasingly bullish on Sernova (TSX:SVA) (OTC:SEOVF)!

Echelon Wealth Partners analyst Douglas Loe thinks Sernova (TSX:SVA) (OTC:SEOVF) has massive upside [6]. Not only did the analyst give a $1 price target for the stock he also backed up his “Speculative Buy” rating with a clear explanation of the company’s future prospects.

“Cell Pouch met virtually all of the performance specifications that it would need to meet to demonstrate its medical utility as a regenerative medicine-enabling cell reservoir platform.”

On top of this, Loe explains that he sees no reason to assume that the Cell Pouch™ as used by other patients in the trial with similar disease profiles cannot exhibit similarly strong performance.

“We expect new case data from the University of Chicago T1D/Cell Pouch program to generate new case data in coming quarters and for the trial to lead directly into formal pivotal T1D testing once concluded, possibly by end-of-F2020, and we look for tangible updates on both the hemophilia A and hypothyroidism preclinical programs within the next few quarters.”

Looking Beyond Diabetes: Sernova (TSX:SVA) (OTC:SEOVF) Builds Further Onto Its Pipeline

There’s no denying the potential of Sernova (TSX:SVA) (OTC:SEOVF)’s Cell Pouch™ for diabetes but that’s just the tip of the iceberg. In fact, Sernova (TSX:SVA) (OTC:SEOVF) has several key indications for other diseases:

Specifically, its Hemophilia A treatment could be next in line. Hemophilia A, also called factor VIII (FVIII) deficiency or classic hemophilia, is a genetic disorder caused by missing or defective factor VIII, a clotting protein. The disease occurs in 1 in 5,000 live male births and is about four times as common as hemophilia B. The number of people with hemophilia in world is not well known, but estimated at more than 400,000 people [7].

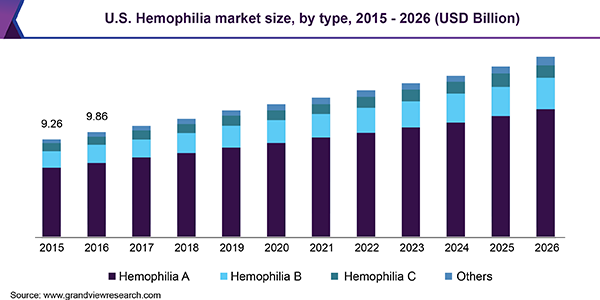

Medications to treat hemophilia cost an average of more than $270,000 annually per patient [8]. Furthermore, Grand View Research estimates the global hemophilia market to be valued at US$11.1 billion in 2018.

Key therapies analyzed in the hemophilia market include replacement therapy, Immune Tolerance Induction therapy, and gene therapy. Gene therapy is an evolving field focused on identifying defective DNA bases and reinstating functional ones. Hence, this segment is expected to present industry players with the most lucrative opportunities over the forecast period.

First In The World

Development of a product capable of producing an effective level of Factor VIII within the Cell Pouch™ environment has the potential to provide hemophilia A patients with better protection against dangerous episodes of excessive bleeding and greatly reduce annual therapy costs. Significant progress has already been achieved in the development of what is being called a ‘first in world’ personalized regenerative medicine therapy for the treatment of Hemophilia A patients by the HemAcure Consortium.

Ground-Breaking Developments Achieved by the Consortium:

- A reliable procedure has been implemented to isolate and maintain required endothelial cells from a sample of the patient’s blood.

- Using a novel gene correction process, the cells have been corrected and tuned to reliably produce the required Factor VIII to treat Hemophilia A.

- The cells have been successfully scaled up to achieve the required therapeutic number, and cryopreserved for shipping and future transplant into the implanted Cell Pouch.

“Sernova’s Cell Pouch platform technologies are achieving important world-first milestones in both diabetes and now hemophilia, two significant clinical indications which are being disrupted by its regenerative medicine approach aimed at significantly improving patient quality of life.” – Dr. Philip Toleikis, Sernova President and CEO.

Elite Team Of Management

Key management has built a business around industry-disrupting technology and the years of experience show why:

Dr. Philip M. Toleikis – President & CEO

Dr. Toleikis is currently President and Chief Executive Officer of Sernova Corp since April 2009. From 2006 until 2009, Dr. Toleikis consulted for multiple device, combination product and pharmaceutical companies. From 1996 to 2006 he held multiple roles at Angiotech Pharmaceuticals, Inc. including Vice President, Research and Development – Pharmacology and Drug Screening where he built a product development team of over 50 scientists and was responsible for multiple corporate and academic product development collaborations.

While at Sernova, Dr. Toleikis has secured over $20 million in various forms of financings, including equity raises and multiple non-dilutive grants and has been responsible for negotiating a worldwide exclusive license with UHN for its stem cell derived technologies as well as developing business relationships and or collaborations with multiple pharmaceutical and academic institutions involving its Cell Pouch™ device and cell technologies.

Dr. Toleikis is the author of multiple issued patents, over 110 patent applications, and multiple scientific publications involving transplantation, metabolic, cardiovascular, oncology, and autoimmune disease. He obtained his Ph.D. in Medicine, Pharmacology and Therapeutics from the University of British Columbia, his M.Sc. at the University of Michigan and B.A. at the University of Vermont.

Frank Holler – Director and Chairman – Board of Directors

Mr. Holler is currently President &CEO of Ponderosa Capital Inc and has a long history of serving at top roles. Mr. Holler previously served as Chairman &CEO of BC Advantage Funds Ltd., a venture capital firm investing in emerging technology companies in British Columbia. He was also President and CEO of Xenon Pharmaceuticals Inc., a NASDAQ listed, genomics-based drug development company. This is in addition to his experience serving as President and CEO of ID Biomedical Corporation, a TSX/Nasdaq vaccine development company and being a founding director of Angiotech Pharmaceuticals, a TSX/ NASDAQ listed biotechnology company.

Jeffrey Bacha – Director

Mr. Bacha has consulted with and lead a number of life sciences companies. He co-founded DelMar Pharmaceuticals in 2010 and led the company’s growth through its listing on NASDAQ in 2016 and currently serves as a member of the company’s board of directors. Previously he served as the Chief Executive Officer and Chairman of the Company prior to recruiting both a seasoned independent Chair and interim Chief Executive to join the DelMar Pharmaceuticals leadership team.

He is a seasoned executive leader with 20 years of life sciences experience in the areas of operations, strategy and finance for biotechnology, pharmaceutical and medical device companies in Canada, the United States, and Europe. His experiences include successful public and private company building from both a start-up and turn around perspective; establishing and leading thriving management and technical teams; and raising capital in both the public and private markets.

Deborah Brown – Director

Deborah M. Brown is currently Managing Partner at Accelera Canada Ltd. Ms. Brown has served as President of EMD Serono, a division of Merck KGaA, Executive Vice President at Serono US, General Manager, Director of Marketing, and Business Unit Director at Serono Canada and Manager, International Regulatory at Pasteur Merieux Connaught. Ms. Brown is a former Board Chair of Rx&D and former board member of BIOTECanada. She sits on the board of several corporate and not-for-profit organizations, including Life Sciences Ontario and the Hamilton/Burlington SPCA.

James Parsons –Director

Mr. Parsons is currently Chief Financial Officer of Trillium Therapeutics Inc. He was also Vice President Finance and Corporate Secretary at DiaMedica Therapeutics Inc.

Mr. Parsons has a broad background in the life sciences industry across therapeutics, diagnostics and device companies and over 25 years of financial management experience. Mr. Parsons has secured over $300 million of various forms of financing during his career and has advised and assisted on over $200 million of product licensing deals.

Clinical Stage Biotech Stocks Could Present First-In-Line Opportunity

This isn’t just a story about breakthrough diabetes or hemophilia treatment technologies. We’re also talking about a bigger picture with clinical-stage biotechnology companies. Case in point, anyone can call a blue-chip biotech stock a success. But were they there when that company was in its early clinical or event preclinical stages? If that question were asked to most about Pfizer or Bayer today, the answer would likely be “no.”

But there are countless examples of clinical-stage companies hitting it big after reporting meaningful trial results. And it’s usually the early onlookers who may have the upper hand at capitalizing:

Deciphera Pharmaceuticals, Inc. more than doubled after reporting positive top line results from a phase 3 clinical study from $19.95 to as high as $42.99… 115%

CorMedix, Inc. Exploded From $6.30 to $13.60 Following Positive Interim Study Results … 116%

CEL-SCI Corporation Jumps From $3.00 March 2019 To Nearly $9 Following Series Of Phase Trial Updates… 199%

Corindus Vascular Robotics, Inc. Rallies from $0.99 At the Start of 2019 to highs of $4.27 Following Agreement to Be Acquired By Siemens Healthineers Just 8 Months Later… 331%

Zynex Rallies From Just $2.60 in January to highs of $11.75… 351%

And these are just a few examples of biotech stock catalysts that sent these companies soaring in 2019! While many of the drugs in development are two-to-five years from reaching the market – if they get that far – betting on the feverish deal activity could give investors a chance to profit near term.

It doesn’t take a rocket scientist to see that biotech catalyst can trigger massive runs, especially in smaller companies. So with major progress being observed on a number of pipeline therapies, Sernova (TSX:SVA) (OTC:SEOVF) may be approaching critical mass, as it were. The market for its drugs has become ripe with opportunities and the latest trend in the biotech sector could lead the way for a new groundswell to begin before the end of the year.

With the recent progress that the company has seen from its early trials, the fervent demand for new therapies, and the stampede of investments flooding into the market from major biotech leaders, it may be time to start looking at small-cap biotech stocks before the Main Street rush opens the floodgates.

Top 5 Reasons To Have Sernova (TSX:SVA) (OTC:SEOVF) On Your Stock List

1. Major acquisition trends from large-cap biotechs could open near term opportunity for promising drug therapies from smaller cap companies

2. Favorable trial results demonstrate considerable potential from Sernova (TSX:SVA) (OTC:SEOVF) treatment pipeline. More near term potential could present itself leading up to new Cell Pouch ™ trials & put it head-to-head with leading companies.

3. Additional benefits of Sernova (TSX:SVA) (OTC:SEOVF)‘s therapies extend to other hotbed markets like Hemophilia A, human growth hormone deficiency, parathyroid hormone deficiency and Parkinson’s disease. This has also earned it enough attention to warrant a $1 price target and “Speculative Buy” Rating by analysts.

4. The market opportunity for Diabetes therapy alone concerns a $186 billion market.

5. Early-stage catalyst for clinical biotech stocks have presented first-mover advantages & Sernova (TSX:SVA) (OTC:SEOVF) has several major milestones that could point toward further clinical developments to come.

LATEST NEWS 10.16.2019 Sernova (SVA) (SEOVF) Finds C-Peptide In Phase I/II Fasting Patient

End Notes:

[1] https://www.alliedmarketresearch.com/request-sample/3542

[2] https://www.healthcareglobal.com/pharmaceutical/johnson-johnson-sells-its-diabetes-business-21bn

[3] https://www.asianscientist.com/2019/02/topnews/phc-acquires-thermo-fisher-anatomical-pathology-business/

[4] https://www.forbes.com/sites/gemmamilne/2018/08/17/bristol-diabetes-spin-out-acquired-by-novo-nordisk-for-800m/#2716ab07465d

[5] https://www.wsj.com/articles/vertex-pharmaceuticals-to-buy-semma-therapeutics-for-950-million-11567526477

[6] https://www.cantechletter.com/2019/07/sernova-corporation-has-an-upside-of-317-per-cent-echelon-says/

[7] https://www.hemophilia.org/About-Us/Fast-Facts

[8] https://www.npr.org/sections/health-shots/2018/03/05/589469361/miracle-of-hemophilia-drugs-comes-at-a-steep-price

Disclaimer: Pursuant to an agreement between Midam Ventures LLC and Sernova (TSX:SVA) (OTC:SEOVF), Midam has been paid $350,000 for a period from September 11, 2019 to September 22, 2020. We may buy or sell additional shares of Sernova (TSX:SVA) (OTC:SEOVF) in the open market at any time, including before, during or after the Website and Information, to provide public dissemination of favorable Information about Sernova (TSX:SVA) (OTC:SEOVF). Click Here For Full Disclaimer.