There was a time, not too long ago where after a night of debauchery and consumption of a few too many adult-beverages, you really had only two options for getting home; call a cab, or try and keep yourself together on public transportation. Then, like an angel from above, Uber came to the world, offering convenient, inexpensive rides to and from wherever one needed to go, and ultimately, Uber’s inception catalyzed the rideshare industry. Years later, the Company is expected to raise upwards of $10 billion later this year in one of the largest initial public offerings in the history of the U.S. stock market. According to several sources, Uber’s IPO will value the company somewhere between $76 billion and $120 billion, however, in light of the recent toxic volatility occurring in the market, some analysts believe Uber’s offering will fetch less than $90 billion.

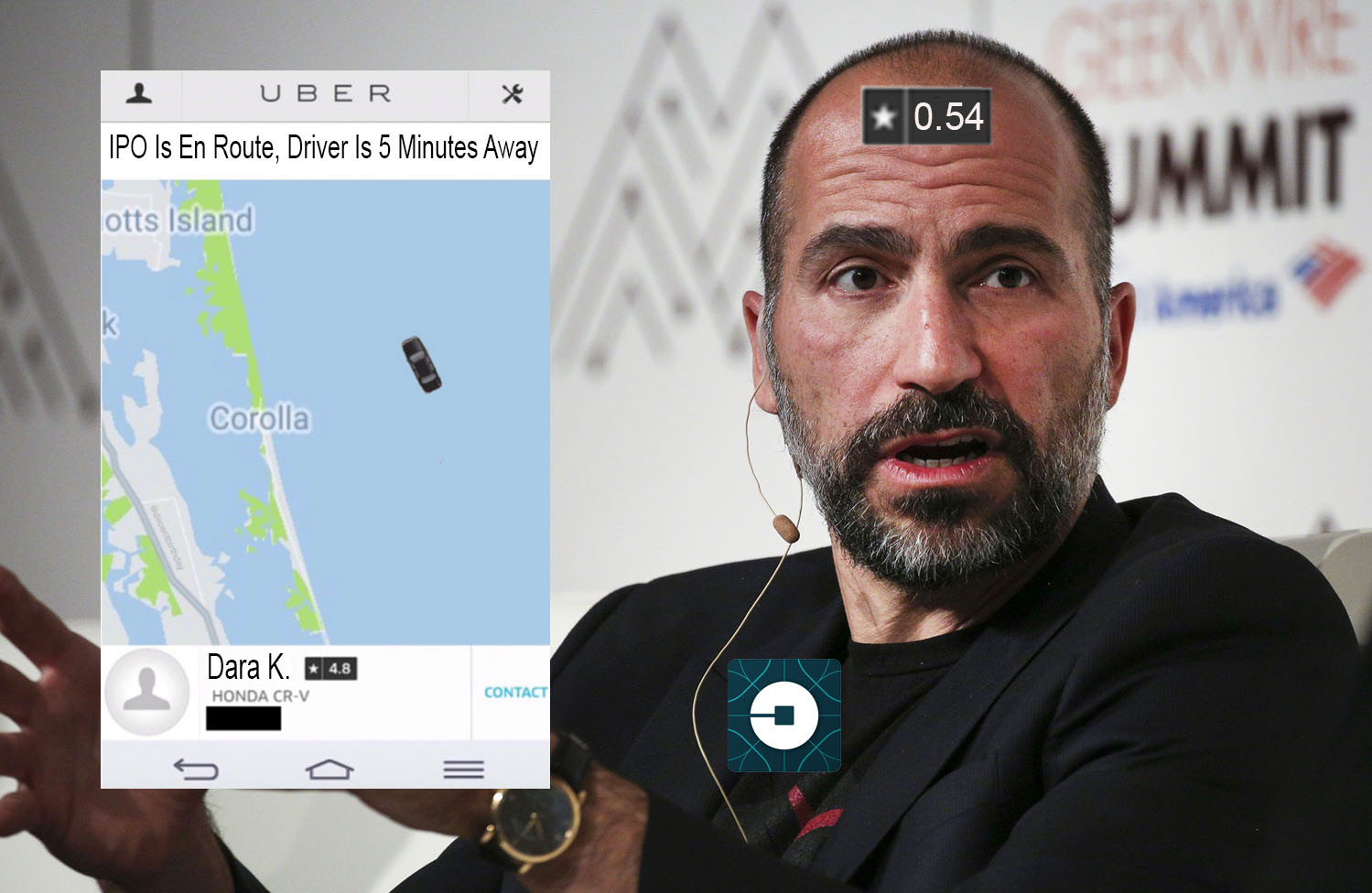

The company’s new chief executive, Dara Khosrowshahi, has done everything in his power to bring estranged investors back into the fold, as well as create new initiatives to attract drivers and riders who might otherwise use any one of the growing ride-hailing applications.

Uber has received numerous proposals from Wall Street banks valuing the company at nearly $120 billion in an initial public offering (IPO) that is likely to occur early 2019. The colossal evaluation is double Uber’s valuation in a fundraising round several months ago, and “more than General Motors., Ford Motor Co. and Fiat Chrysler Automobiles are worth combined.

The two banks responsible for these valuation proposals, Goldman Sachs Group Inc. and Morgan Stanley, have offered their insight as to how to best position Uber’s shares to potential investors, in the event that the company chooses to go public. The Company, founded in 2009, is part of a unique group of highly valued startups who’ve staved off entering the public markets. Since its founding, Uber has brought in bought $20 billion in a combination of debt and equity funding, according to TechCrunch. Recent reports suggest that both Uber, and its ride-hailing rival Lyft, have both filed IPO documents with the Securities and Exchange Commission, which means we are inching closer to monumental offerings from one, or both companies.

“Any investment in Uber is obviously a long-term bet on the future, like someone who invested in Amazon in the early days. One thing Uber chief executive officer Dara Khosrowshahi is doing well is really expanding Uber into a mobility company as opposed to just a ride-hailing company.”

–Bradley Tusk

When Tusk refers to Uber’s foray into building out their mobility division, he’s speaking on how several months ago, Uber caught on to emerging micro mobility industry, which has seen millions of Americans fawn over electric scooters and pedal-assisted bikes left on city sidewalks across the country. For those unfamiliar with the term micro mobility, it applies to any form of transportation other than cars, that allow for ease during “last mile” transport, so these would be electric scooters, pedal-assisted bikes, and perhaps pogo sticks if the situation ever arises for hopping to your dentist appointment.

Uber acquired the bike-sharing startup Jump for a price close to $200 million, thus giving its users access to the increasingly popular form of local transportation. Back in January, Jump closed a $10 million Series A round of funding while simultaneously becoming the first stationary bicycle service to receive a permit to launch in San Francisco. Uber released their first Jump scooters in Santa Monica, and since then Uber riders have been able to locate and claim a Jump electric scooter from the same app that they hail rides. Riders simply scan on QR code located on the center of the steering mechanism and start riding the scooters. The company reports that rides cost $1 to start and $0.15 per minute afterward.