Uber is much more than a convenient ride home when you’re drunk and the executives behind the popular ride-hailing company are willing to go the distance just to prove that sentiment to its users.

Several months ago, Uber caught on to emerging micro mobility industry, which has seen millions of Americans fawn over electric scooters and pedal-assisted bikes left on city sidewalks across the country. Uber acquired the bike-sharing startup Jump for a price close to $200 million, thus giving its users access to the increasingly popular form of local transportation. Back in January, Jump closed a $10 million Series A round of funding while simultaneously becoming the first stationary bicycle service to receive a permit to launch in San Francisco.

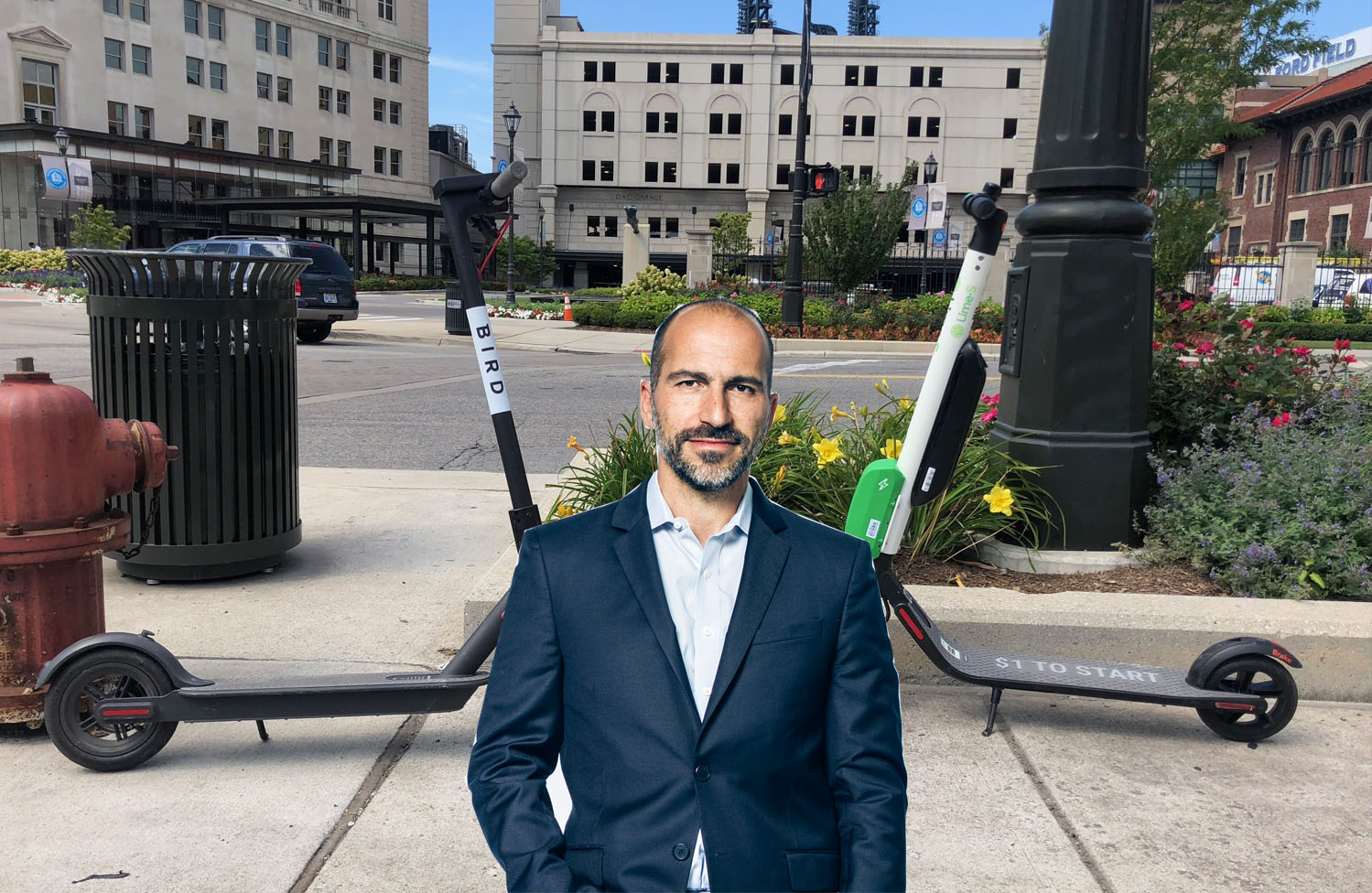

In an interview with TechCrunch Uber CEO Dara Khosrowshahi told reporters that he wants, more than anything, for Uber to become a top urban mobility platform. As cities become overpopulated every single day, more and more cars begin to clog city streets, all the while, people still need a convenient way to travel from one point to another. He said:

“We see the Uber app as moving from just being about car sharing and car-hailing to really helping the consumer get from A to B in the most affordable, most dependable, most convenient way. And we think e-bikes are just a spectacularly great product.”

–Dara Khosrowshahi, Chief Executive Officer, Uber

Uber’s push into the micro mobility sector would’ve been a completely foreign concept if not for companies like Lime and Bird, two scooter-sharing startups, who paved the way for the budding industry. According to recent reports, both companies are worth well over $1 billion, despite each company having several run-ins with city officials regarding permitting over the last year.

The aptly named “Scooter Wars,” which were fought to the death in the liberal paradise of San Francisco, California, came to an end earlier in the year when the SF Municipal Transportation Agency (SFMTA) denied Lime and Bird’s applications for licenses “with the right to operate a pilot program within a city.”

Both Lime and Bird, albeit frustrated by the news, continued to zip down city sidewalks on their scooters, securing funding and public opinion along the way. Several weeks ago, Lime, arguably the more successful micro mobility company of the two, announced that the company had been working on yet another form of alternative transportation, known as “LimePods.” The new car-sharing product line from the company was designed to be “a convenient, affordable, weather-resistant mobility solutions or commuters.”

Fast forward to the always exciting present and word is spreading like wildfire about a potential acquisition of either Lime, Bird, or both if that tickles the company’s fancy. Now, what company has the capital to back this deal up? According to insight gather by The Information, Uber is discussing, with both Lime and Bird, the potential to team up to create a micro mobility powerhouse. As promising as this deal is for both Uber, and its eventual investors once the company eventually goes public with an IPO later this year, I don’t believe the chief executives at either Bird or Lime are ready to give up their independence and position in the market.

Just last week, Bird announced that it will start selling its scooters to entrepreneurs and small business owners looking to manage their own e-scooter business as part of a new service called Bird Platform. According to the announcement of the new service, the newly independent scooter operators will have access to Bird’s network of chargers and mechanics, in exchange for 20% off the cost of each ride.

“In the last year of operating, we kept getting these inbound requests from entrepreneurs that really wanted to take Bird to their cities. I think there’s been a lot of people passionate about the electric scooter movement and taking cars off the road. There are a lot of entrepreneurs who want to bring Bird to their city.”

–Travis VanderZanden, Chief Executive Officer, Bird

Together, both Bird and Lime are transforming the micro mobility industry into a sector that’s garnering significant attention as e-scooters are quickly becoming a publicly-accepted form of “last-mile” transportation in the US. If Uber has any shot of acquiring one or both companies, they’ll need to be well-prepared to shell out over $2 billion for each brand, as well as assure each company’s executives that they’ll retain autonomy of their operations, with the added bonus of support from a company destined to go public if everything works out.