The marijuana industry, in the past several years, has become a tour de force in the global marketplace. With Canada becoming the first G7 nation to legalize the recreational use of cannabis, around the world, other countries have been putting in long hours at the plant to catch up in terms of drafting and enacting cannabis legislation. As marijuana has garnered popular opinion from sectors that historically were opposed to the substance, such as doctors and other experts from the medical sphere, companies from other industries have emerged from the woodwork, hungry to invest in cannabis. Recent statistics indicate that the total demand for marijuana in the United States, including both legal and black market sales, is estimated at $52.5 billion, according to information gathered by Forbes.

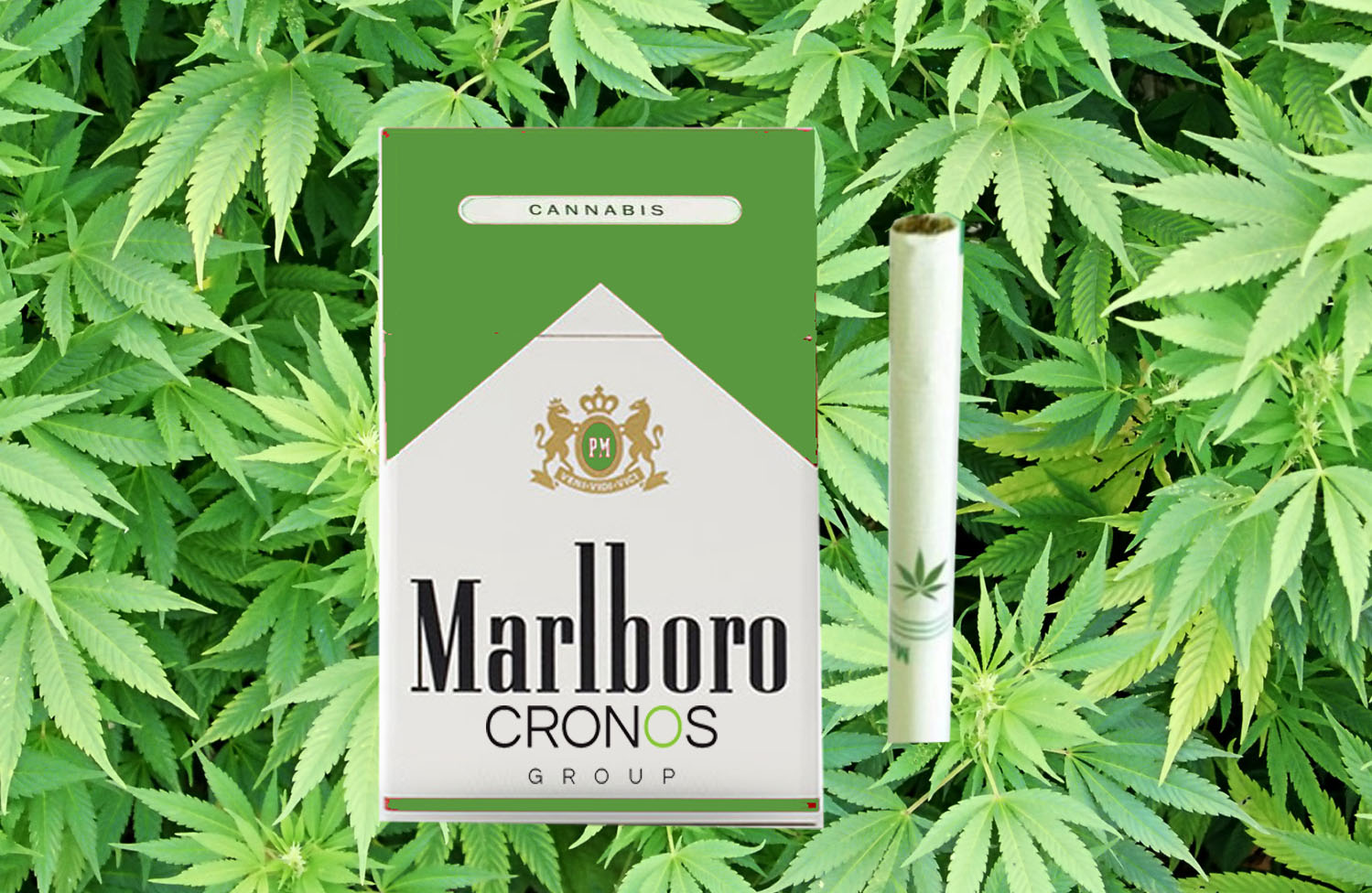

Several months ago, the cannabis industry, budding with excitement from Canada’s legislation, piqued the interest of several large tobacco companies, notably Altria (MO), the tobacco manufacturer responsible for producing Marlboro brand products. Recently, domestic cigarette sales have been declining, most likely due to the advent of e-cigarettes, vapes, and rising popularity, and access, of marijuana. Altria (MO) recognized that the name of the game was no longer cigarettes, but rather finding a way to capitalize on the lucrative marijuana industry gaining tread in the United States.

Tapping into the potential boundlessness of success taking place in the Canadian cannabis market, Altria Group (MO) announced on Friday that, after weeks of speculation, it would buy a 45% stake in Cronos Group (CRON), one of the largest producers of cannabis in Canada, for approximately $1.8 billion. Howard Willard, Altria’s (MO) chief executive lauded his company’s investment as “an exciting growth opportunity in the emerging global cannabis” market. This investment not only indicates a tidal shift in corporate perspective on cannabis after nearly a century of prohibition but moreover, this represents a fear felt by big tobacco that their industry is slowly but surely losing its predominance.

Cronos (CRON), as a key producer of cannabis for the Canadian market, produces roughly 258,000 pounds of marijuana per year. Although they have an extremely high rate of production, in the past few months, the company has expressed concerns with excess inventory, a roadblock that will undoubtedly be overcome with the support of Altria’s (MO) global distribution capabilities.

“Altria is the idea partner for Cronos Group, providing the resources and expertise we need to meaningfully accelerate our strategic growth. The proceeds from Altria’s investment will enable us to more quickly expand our global infrastructure and distribution footprint, while also increasing investments in R&D and brands that resonate with our consumers. Importantly, Altria shares our vision of driving long-term value through innovation, and we look forward to continuing to differentiate in this area…”

–Mike Gorenstein, Chairman/President & Chief Executive Officer, Cronos Group

Altria (MO) is not the first industry-leading company to invest outside of the traditional scope by bringing cannabis into the fold. Several months ago, Constellation Brands (STZ), the parent company of alcoholic beverage brands such as Corona, Modelo, Pacifico, Robert Mondavi, and others, announced a significant expansion of their strategic partnership with Canopy Growth, one of the world’s leading cannabis producers. Given Constellation’s (STZ) reputation in the alcoholic beverage industry, their investment in Canopy was predicated on the possibility of developing and distributing cannabis-infused beverages for the global marketplace.

At the time of the investment, Constellation Brand’s CEO Rob Sands gave a statement on his thoughts about the deal:

“Over the past year, we’ve come to better understand the cannabis market, the tremendous growth opportunity it presents, and Canopy’s market-leading capabilities in this space.”

–Rob Sand, Chief Executive Officer, Constellation Brands

Circling back to the Altria (MO) deal, while investing in Cronos (CRON) is an interesting direction and will undoubtedly attract investor attention, the fact of the matter is that the tobacco industry has quite a bad rep. Cannabis has only recently been accepted by public investors as an industry/product worth investing in. This acceptance has come from extensive research done by medical experts to prove cannabis’ medicinal qualities.

Perhaps Cronos Group’s (CRON) partnership with Altria (MO), a company synonymous with a product that is less than healthy for its consumers, may end up besmirching the good name that cannabis producers and retailers have worked so hard to cultivate.