When we were younger, our parents would tell us that, if we set our minds to it, and really tried our best, we could be whatever we wanted to be when we grew up. The basis from that question would later be brought up in kindergarten, where teachers would ask us what we want to be when we get older. I always said that I wanted to be a firefighter, but friends of mine would say doctors, astronauts, and scientists. To be fair, at that exact moment in time, each of those career paths were as uncertain as the rest of our collective futures.

We were told that, in order to live out our dreams, we would need to go to college. If I could travel back in time and tell some of these kids that college would mean partying, all-nighters, and all you’d leave with was a $50,000 piece of paper saying you spent four years studying literature, maybe they would’ve done something different. Nevertheless, parents want the best for their children, and when parents say that they’ll do anything to help their kids be successful, I truly believe they mean it.

Earlier this week, it was discovered that over fifty people were involved in one of the largest-scale college admissions scandals in the history of the United States. These people, all of which were parents of college-hopefuls, worked with TV producer Rick Singer to collectively pay over $25 million for Singer’s “company” to falsify student test scores and athletic performance records to help students get into universities they otherwise wouldn’t have a chance at getting into.

While this scandal is exciting and upsetting for the students who probably had only good intentions, at the core of the story lies a dangerous systemic issue relating to affluent individuals believing they can simply spend to fix their problems.

According to the official court filing, Rick Singer, and others known and unwon to the Grand Jury:

“…carried out the racketeering conspiracy which included facilitating cheating on the ACT and SAT exams in exchange for bribes by arranging for or allowing a third party — to secretly take the exams in place of the actual students, or to replace the students’ exam responses…designing applicants as purported recruits for competitive college athletic teams, without regard for the applicants’ athletic abilities…”

–United States District Court of Massachusetts

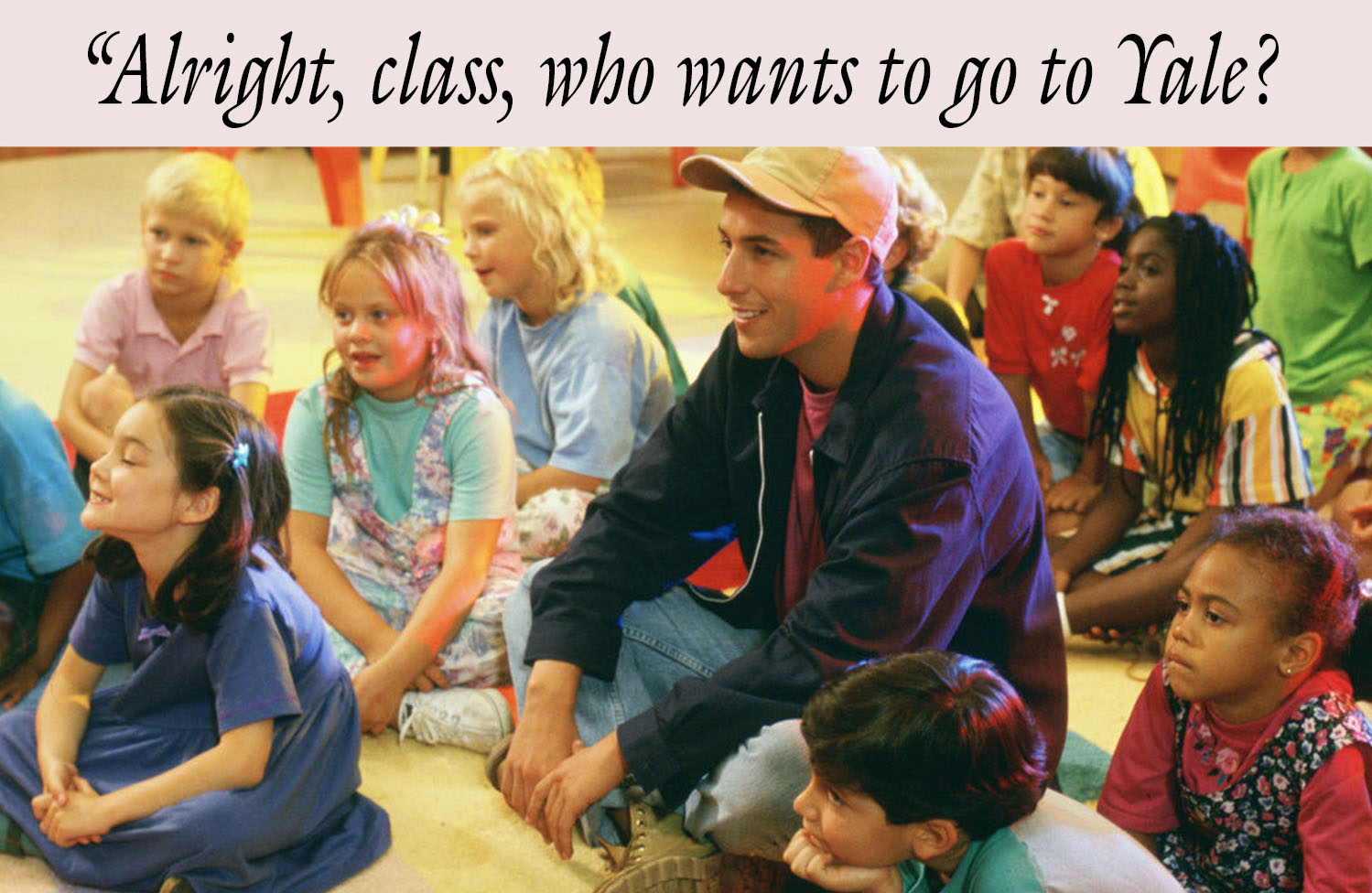

In addition to faking standardized test scores and athletic statistics, the scandal also included bribing athletic coaches at elite colleges including Yale and USC, who would subsequently vouch on behalf of these students to the respective school’s admissions departments. Coaches would advocate for students who, in some cases, didn’t even play sports.

It’s no mystery that students are accepted to elite colleges under fiscal pretenses more often than not. If a student is, by most metrics, unintelligent, if their parent is reasonably wealthy, a nice donation to the school often times tips the scale when it has to. Interestingly enough, this may or may not be the scenario which allowed President Donald Trump to attend the University of Pennsylvania, but Trump’s taken up the media attention enough thus far, so we’ll remain focused on the issue here.

As the scandal continues to unfold, what has become disgustingly clear is that the majority of these parents were so determined to get their children into these schools purely for the bragging rights. If a child has never expressed interest in attending Yale or USC, as many of these students never said to their parents, why spend millions of dollars, behind closed doors, to try and get them accepted to these places. It brings up the question of whether the name of the university was more important to these parents than their children’s collegiate experience.