Back in 2015, a crack commando unit was sent to prison by a military court for a crime they didn’t commit. These individuals promptly escaped from a maximum security stockade to the Los Angeles underground. Today, still wanted by the government, they survive as soldiers of fortune. If you have a problem if no one else can help, and if you can find them, maybe you can hire Google ATAP (advanced technology and projects). While that’s not exactly how Google’s (GOOGL) tech incubator team was formed, and more than likely was text is taken from the introduction to a TV show from the 70’s, Google’s (GOOGL) in-house skunkworks collective has been working on a project akin to the unparalleled quality of an episode of the A-Team, if not greater.

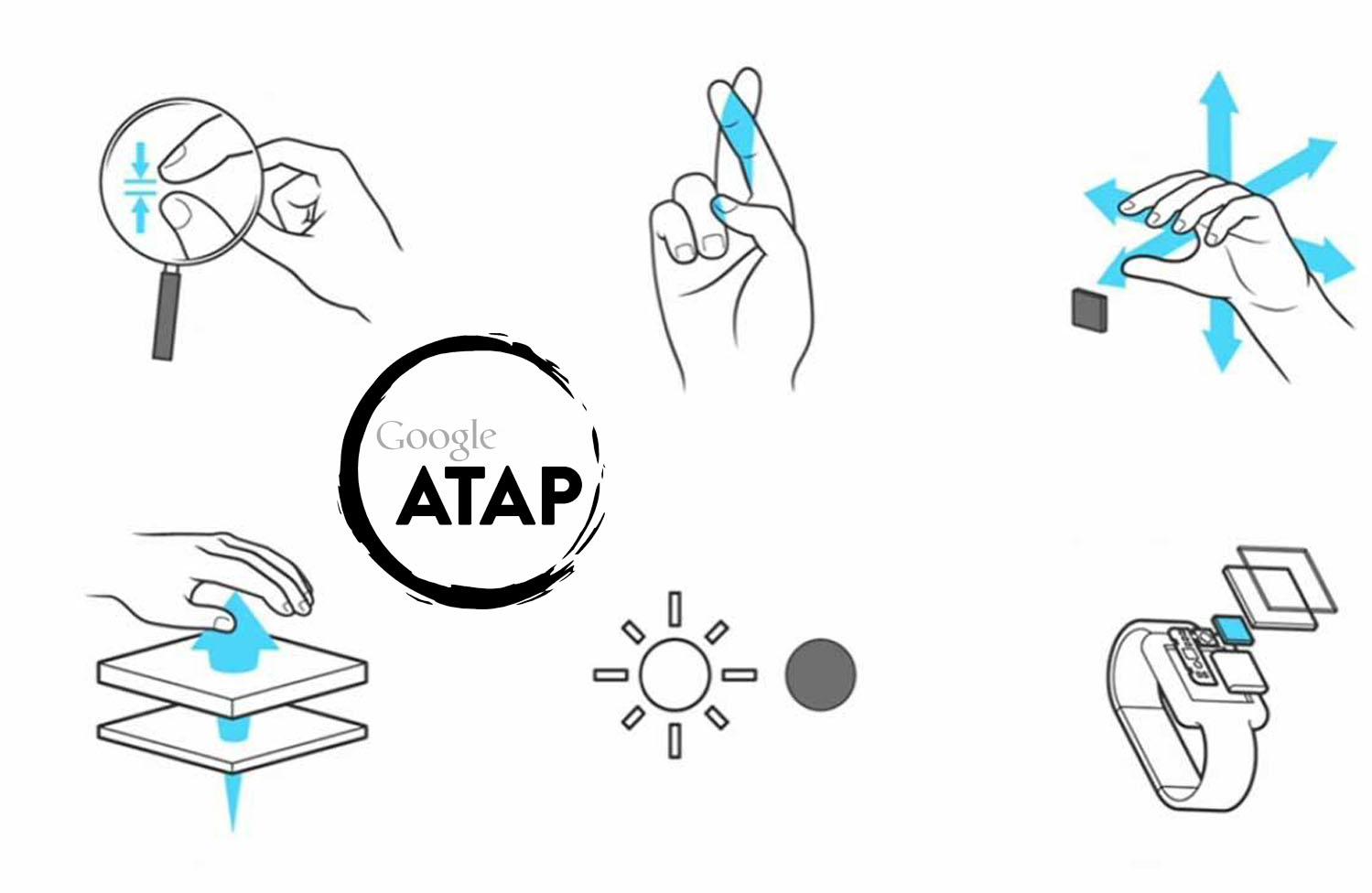

Imagine being able to control your computer or smartphone simply by making the relevant gesture depending on how you want to interact with your device. Google’s (GOOGL) ATAP Project Soli has purposed itself with making this futuristic dream-like concept a practical reality. The Soli Project first began in 2015, and in that time, the ATAP team has had tremendous breakthroughs with the developmental tech. Pausing for a moment to give you a brief, but necessary science lesson, radar is a technology which transmits a radio wave towards a target, and the receiver of the radar signal intercepts reflective energy from that target. Operating with the goal of “harnessing the power of hand and finger manipulation to make it easier to interact with devices and screens,” Project Soli utilizes radar technology to capture signals from human hands and transmit those signals into interactions on the screens of our favorite tablets, smartphones, and computers, according to TechCrunch.

In recent news, the Federal Communications Commission (FCC) announced earlier this week that it would grant Project Soli an official waiver to allow the team to operate their radar-sensing device at higher, more optimal power levels, given that the FCC oversees all radio wave transmissions.

“…We grant a request by Google, LLC for waiver of section…of the rules governing short-range interactive motion sensing devices, consistent with the parameters set forth in the Google-Facebook Joint ex party Filing, to permit the certification and marketing of its Project Soli field disturbance sensor to operate at higher power levels than currently allowed. In addition, we waive compliance of the rules to allow users to operate Google Soli devices while aboard aircraft…We further find that grant of the waiver will serve the public interest by providing for innovative device control features using touchless hand gesture technology.”

–Federal Communications Commission commenting on Project Soli

The FCC’s regulatory approval of Project Soli is not only an incredible breakthrough for the Google ATAP team (GOOGL) but more than that, its an indication of a significant milestone in human history. Few would argue against the importance of touch as a means for communicating emotions between individuals. We use our sense of touch to interact with the world around us, sensing danger, pleasure, and pain all from the physical sensation of feeling. To integrate this tactile function of the human body into cutting-edge technology is an indication that the gap between the physical and the virtual worlds is narrowing as time goes on. While news of Project Soli’s FCC waiver is exciting for some, it may be quite harrowing for others. There are those on this Earth that fear the future, and the changes that accompany it. According to reports, Project Soli will include a haptic feedback element, allowing users to receive physical responses to hand gestures, blurring the line between real and virtual even further.

In terms of releasing Soli to the public, the ATAP team is shooting for broad availability later this year, according to TechCrunch reports. The first iteration of Soli will most likely be incorporated into the function of wearable devices such as smartwatches.