At one time or another, we’ve all been bitten by the buyer’s remorse bug. You know that feeling when you fantasize about all the incredible experiences you plan on having with that new thing you’re about to buy? Imagining yourself sitting together with your new device or physical representation of a recent investment on a beach, with the sun setting beyond the horizon, and just when the moment presents itself, you lean in for that special…Yikes, got carried away there for a moment.

Where were we? Oh, yes! Buyer’s remorse!

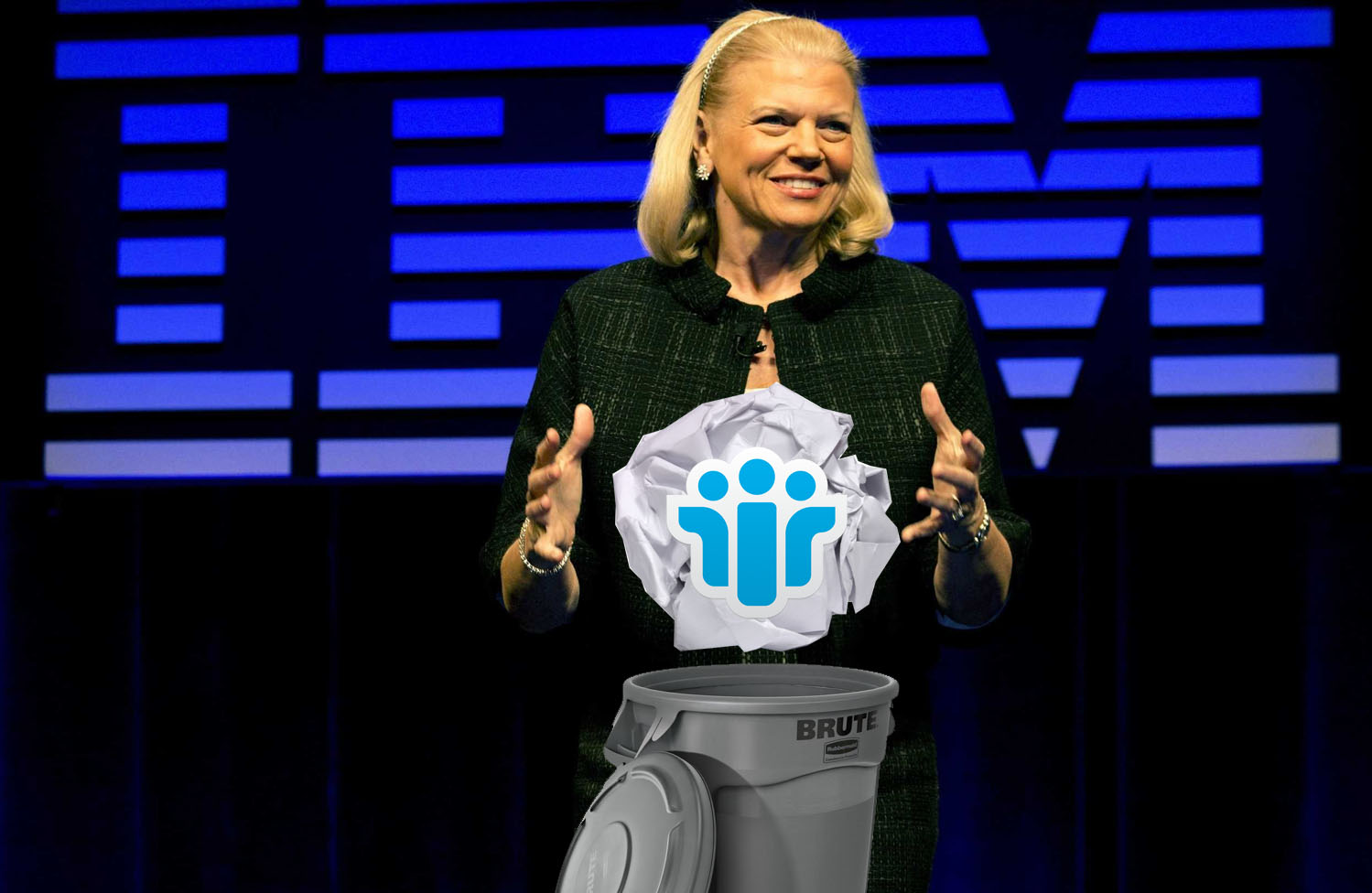

A little more than twenty years ago, International Business Machines, more commonly referred to as IBM (IBM), invested $3.5 billion in cash to acquire the Lotus Development Corporation’s then-innovative product, Lotus Notes. Think of Lotus Notes as an archaic version of a Google (GOOGL) Doc, allow computers that would otherwise be disjointed to work collaboratively on a shared platform. Given that the year was 1995, Lotus Notes was a revolutionary product, and IBM (IBM) wanted in. Several decades and the birth of yours truly later, IBM (IBM) is feeling serious buyer’s remorse. In October of last year, IBM struck a “strategic partnership” with India-based HCL Technologies that would see the latter company oversee any and all development of IBM’s (IBM) Notes, Domino, Sametime, and Verse tools, all acquired in the Lotus deal of ’95. This was just the start of IBM’s (IBM) groundwork to part with anything having to do with products/tools first developed by Lotus, though IBM (IBM) retained control of sales and marketing for all of the above.

As the tech industry has shifted over the years from storing data on physical hard drives in temperature-controlled warehouses around the world to simply uploading their information to ‘the cloud,’ companies like IBM (IBM) have invested in minimizing their use of physical space by maximizing their cloud-computing capabilities. At the tail-end of last month, IBM (IBM) spent $34 billion to acquire open software company Red Hat (RHT).

IBM’s (IBM) chief executive officer Ginni Rometty told CNBC in an interview, that she felt the acquisition price was more than fair given the value of Red Hat (RHT).

“This is a very fair price…(Red Hat CEO Jim Whitehurst) has built a great company, and unlike others, high growth, high profit and cash and so this is why I think really those are important things for our investors.”

–Ginni Rometty, CEO, IBM

Rometty, in an interview with Reuters, spoke on consumer demand for cloud services and IBM’s (IBM) decision to get their foot in the door, as the rise of the “hybrid cloud” becomes widely used as a means for companies to run software store their data. Companies like Amazon Web Services and Google Cloud have data centers that utilize “hybrid cloud” technology, and IBM’s (IBM) acquisition of Red Hat (RHT) would give them access to this new market.

However beneficial IBM’s (IBM) acquisition of Red Hat may turn out to be in the long run, spending $34 billion is no easy expenditure, no matter how significant the market capitalization of the company. In an attempt to balance their books and trend cash positive, IBM (IBM) announced on Friday that it would be selling all remaining components from its acquisition of Lotus, back in 1995, to HCL, for $1.8 billion. While IBM hates to see its stake in Lotus fall to the wayside, HCL will continue to build out the Notes/Domino business its been working on for two decades.

“The large-scale deployments of these products provide us with a great opportunity to reach and serve thousands of global enterprises across a wide range of industries and markets.”

–C Vijayakumar, President & Chief Executive Officer, HCL Technologies