Just before Darth Vader and Obi-Wan Kenobi “unsheathe” their lightsabers to battle in the first Star Wars film, Obi-Wan warns Vader that if he should strike him down, he will become more powerful than Darth Vader could possibly imagine. Aside from being one of the most bad-ass scenes in film history, this demonstrated a character’s unbound bravery in the face of pure evil and doubt. I couldn’t tell you where metaphors would be without the storytelling skills of George Lucas and the Star Wars franchise, but I digress. This notion of getting back on the horse even if you’ve managed to fall off is something easier said than done when speaking about companies that have been struggling to revitalize their operations.

Back in December 2018, Nvidia (NVDA), the company reversed for its top-line graphical processing units (GPUs) for gaming and computer-assisted design lost the majority of its business to the likes of Microsoft (MSFT) and Sony (SNE), ultimately deciding to invest in powering computers for the crypto market. Consumers began using Nvidia’s (NVDA) products for crypto mining, resulting in a drastic shortage of GPUs for the Company’s primary gaming division.

“We’re sold out of many of our high-end SKUs, and so its a real challenge keeping [graphics cards’ in the marketplace for games. At the highest level the way to think about that is because of the philosophy of cryptocurrency — which is really about taking advantage of distributed high-performance computing — there are supercomputers in the hands of almost everybody in the world so that no singular force or entity that can control the currency.”

-Jensen Huang, Chief Executive Officer, Nvidia

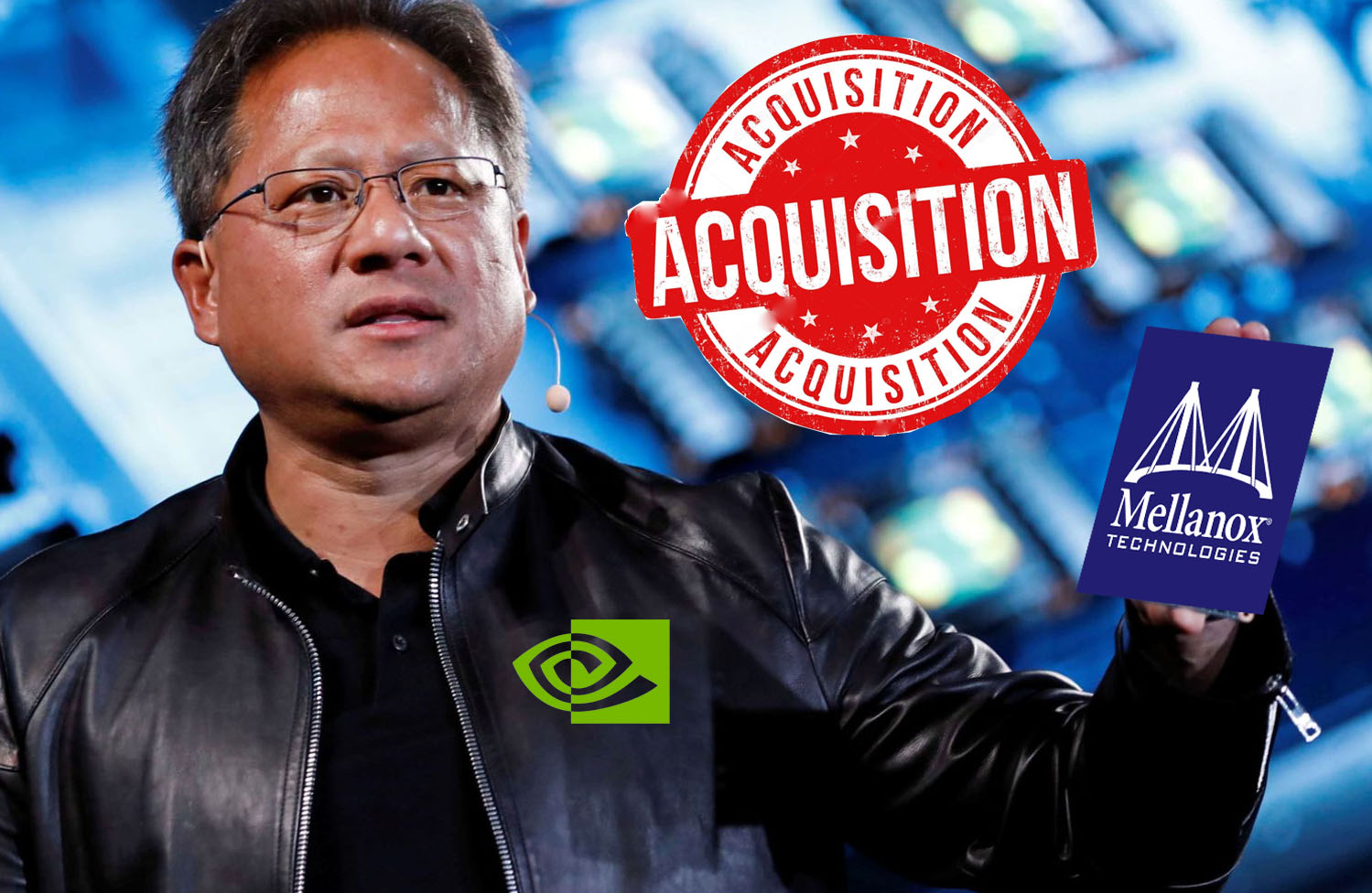

After months of fending off imminent extinction, Nvidia (NVDA) today announced that the Company has reached a definitive agreement with Mellanox, under which Nvidia (NVDA) will acquire Mellanox. Per the details of the agreement, Nvidia (NVDA) will acquire all of the issued and outstanding common shares of Mellanox for $125 per share in cash, representing a total enterprise value of approximately $6.9 billion. Once complete, the combination is expected to be immediately accretive to Nvidia’s (NVDA) non-GAAP gross margin, non-GAAP earnings per share and free cash flow.

The news of Nvidia’s acquisition comes after months of what the media has referred to as a bidding war between Nvidia (NVDA), Intel (INTC), and Microsoft (MSFT) for the Israel-based company. According to a TechCrunch report, the deal between Nvidia (NVDA) and Mellanox will represent two companies responsible for powering over half of the world’s 500 biggest computers covering “every major cloud service provider and computer maker.”

“The emergence ion AI and data science, as well as billions of simultaneous computer users, is fueling skyrocketing demand on the world’s data centers. Addressing this demand will require holistic architectures that connect vast numbers of fast computing nodes over intelligent networking fabrics to form a giant datacenter-scale compute engine. We’re excited to unite NVIDIA’s accelerated computing platform with Mellanox’s world-renowned accelerated networking platform under one roof to create next-generation datacenter-scale computing solutions.”

–Jensen Huang, Founder and CEO of Nvidia

Ultimately, Nvidia’s (NVDA) acquisition of Mellanox, while frustrating for the companies who failed to acquire the company, will allow for the development of powerful computing technologies which will help improve how the world’s technology functions and communicates. Following the announcement, Eyal Waldman, founder and CEO of Mellanox, explained that he and Huang share a similar vision for accelerating the future of computing and that “combining the two companies comes as a natural extension” of the longstanding partnership between the two companies.