Biotech stocks and the biotech sector in general have been one of the fastest-growing sectors in the stock market for many years. Experts believe that the growth is going to continue for the foreseeable future. Most of these companies use cutting edge technology in order to produce new treatments.

Therefore, it’s an industry that never stands still. So, it’s also true that there are a number of interesting companies and here is a look at 3 biotech stocks to watch in September

Biotech Stocks to Watch #1 Pharmacyte Biotech (PMCB)

If you’re looking at PharmaCyte Biotech (PMCB Stock Report) at this exact moment, you’re seeing it before the company begins clinical trials and just as it’s preparing to complete its Investigational New Drug application for the FDA. Whether you’re new to biotech stocks or a seasoned vet, you should understand how important milestones like this are for a company.

The United States Food and Drug Administration’s Investigational New Drug (IND) program is the means by which a pharmaceutical company obtains permission to start human clinical trials and to ship an experimental drug across state lines before a marketing application for the drug has been approved.

Right now, PharmaCyte Biotech (PMCB) is putting together the necessary material for its planned clinical trial for inoperable pancreatic cancer, one of the most deadly forms of cancer today. Just to give you an idea, pancreatic cancer, in general, has the highest death rate of all major cancers. Only 9% of people with this cancer will survive more than five years [1]. Could those looking at PharmaCyte Biotech (PMCB) at this exact moment be looking at a “right place/right time” scenario?

Well, as Dr. Hidalgo, Principal Investigator of PharmaCyte’s trial, says,

“If the results are very positive, these results may pave the way for an accelerated approval process through one or more avenues afforded by the FDA.”

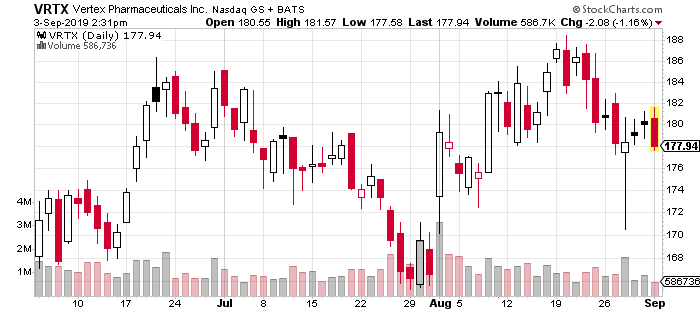

Biotech Stocks to Watch #2: Vertex Pharmaceuticals

The first one to consider in this regard if Vertex Pharmaceuticals Incorporated (VRTX Stock Report), which is the leading player in the cystic fibrosis treatment market and it is believed that its dominance could continue for the foreseeable future. More importantly, the company has as many as three products that have been approved. The three products in question are Symdeko, Kalydeco, and Orkambi.

The company rakes in $1 billion from the last two medicines alone, while the first one is all set to become one of the company’s most popular products soon. On the other hand, its triple-drug CF combination therapy product is also set to get the much-needed approval and cold well begin the start of great times for the company. That being said, it is in the cystic fibrosis market that the company’s strength lies and it is all set to dominate this particular market over the years. It could prove to be a highly intelligent investment.

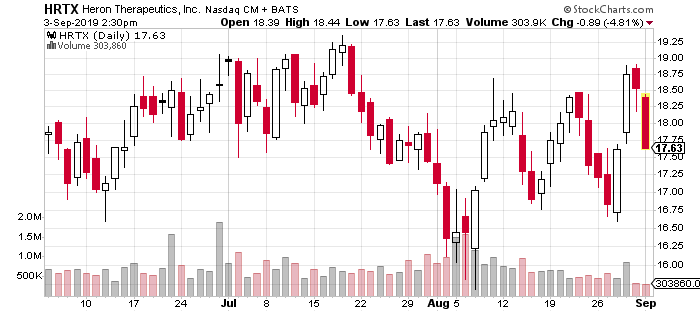

Biotech Stocks to Watch #3: Heron Therapeutics

The other interesting biotech stock that should be on the watch lists of most investors is Heron Therapeutics Inc (HRTX Stock Report). The company is involved in producing pain killers and anti-nausea treatments that are devoid of opioids. Although the company is currently of the small-cap variant, there definitely is a lot of potential for growth.

More importantly, the well-known gurus of the world of biotech, the Baker Brother have invested heavily in the stock and that should be an indicator of the sort of promise the company holds. While the rejection of HTX-011 proved to be a setback, it later emerged that it was primarily due to technical reasons.

End Notes:

[1] http://pancreatic.org/pancreatic-cancer/pancreatic-cancer-facts/

Disclaimer: Pursuant to an agreement between MIDAM VENTURES, LLC and Complete Investment And Management LLC, a Non-affiliate Third Party, Midam was hired for a period from 07/09/2019 – 8/09/2019 to publicly disseminate information about PharmaCyte Biotech including on the Website and other media including Facebook and Twitter. We were paid $150,000 (CASH) for & were paid “0” shares of restricted common shares. We were paid an additional $150,000 (CASH) BY Complete Investment And Management LLC, a Non-affiliate Third Party, AND HAVE EXTENDED coverage for a period from 8/12/2019 – 9/12/2019. We may buy or sell additional shares of PharmaCyte Biotech in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information. Click Here For Full Disclaimer