New Records In SPY & ETFs Mean Higher Prices For Investors To Buy

There’s no doubt that 2019 was an epic year for the stock market. Stock prices jumped to record levels over numerous sessions. Despite the recent pull-back we’ve seen this week, it hasn’t tipped the overall trend.

Starting off the new year, the S&P 500’s (SPY) broke through yet another new high. This supports the idea that the major public companies are roaring higher right now. But has this separated the earning gap with average workers?

What Do These New Highs Mean For The Average Joe?

If you look at the SPY, for example, the ETF now trades above $300 per unit. Furthermore, the S&P index (SPX) itself trades above $3,200 per unit right now. Let’s take a look at what the average hourly working-class person is making right now.

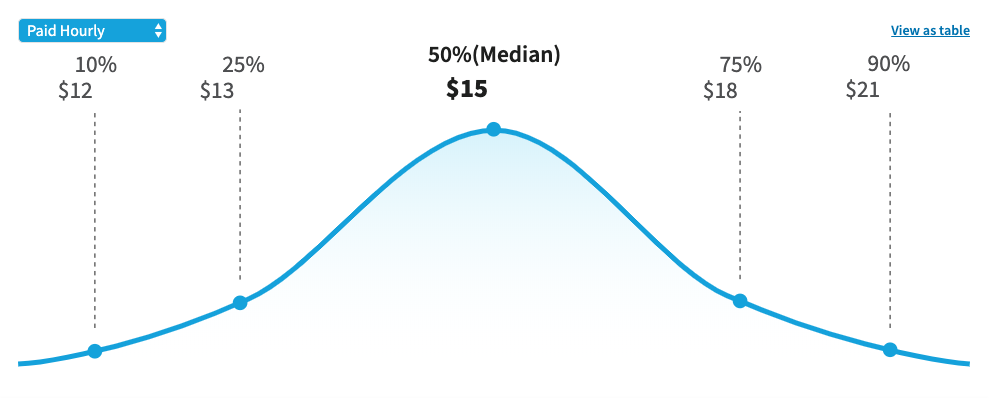

According to data from Salary. com, the median hourly wage for a laborer in the US is around $15. The low end is around $12 and the upper end, $21. If we take the average of $15 per hour, which doesn’t account for taxes, it would take someone between 21 and 22 hours just to buy one unit of the SPY ETF. Now, if you were to invest directly in the index, you’d be looking at more than 213 hours just to pick up one unit of the S&P 500 index itself.

Now, it’s more likely that the SPY is more attainable but that also means more than half of your work-week is dedicated to investing in just 1 unit of SPY. Want 2 units? better get some overtime. But this shouldn’t deter people from investing in stocks. It comes down to investing wisely.

So What’s Next?

The biggest question right now is how can the average worker get involved in the stock market without actively day trading? That’s a good question. Based on a Gallup poll, only 55% of Americans said they were invested in the stock market. Much of this comes from something like a 401(k), IRA, or mutual fund.

“The key on this front is to see how Q4 earnings season plays out. This year’s gains in the equity market were driven nearly entirely by multiple expansion. In order to see gains in the year ahead, we’ll likely need earnings to pick up the slack,” researchers at Bespoke wrote in a December research report.

Read More

- 3 Gold Stocks to Watch As Gold Trades Near Highs

- What’s Next For Tesla Stock Price After Latest Analyst Remarks?

Since the latest U.S. attack on Baghdad, the market has slumped. But will it be enough to make stocks affordable once again? The melt-up on Wall Street still rages on amid this geopolitical unrest.

The Devil’s In The Details

Bespoke Investment Group ran numbers and confirmed that Wall Street has rarely experienced a period as decidedly bullish as late 2019.

The firm calculated how often during the trading day the S&P 500 was up versus the prior days’ close over a rolling 50-day trading period.

Bespoke found that in late December, the S&P 500 was in the green on an intraday basis over 65% of the time. This was a level surpassed only a handful of times since the firm’s intraday numbers began in 1984.

“If history repeats itself we’d see sideways action in January and February and outright declines in March and April.”

This is what happened in the late part of 2018 after US stocks fell hard following a similar stint. One analyst, JJ Kinahan at TD Ameritrade, wants investors to stay grounded. “Things don’t go up forever,” Kinahan said. “You have to be cautious about saying, ‘Everything is at all-time highs, so I’m all in.'”