Apple, Disney, Netflix, Amazon, NBC, Hulu & More are All Competing Within the Global Video Streaming Market and They All Need the Same Thing… New & Original Content! Massive Demand May Create Huge Opportunity for Companies like Fearless Films (FERL)

According to an article published on Reuters the global video streaming market was valued at $26.27 billion in 2015 and is expected to reach $83.41 billion by 2022 growing at a CAGR of 17.9% from 2015 to 2022.

Some reports such as one from Grand View Research have stated “The global video streaming market size is anticipated to reach USD $124.57 Billion by 2025. It is anticipated to expand at a CAGR of 19.6% during the forecast period.”

A Potentially Massive & Original Opportunity

Network TV and the box office films are trying to stay relevant, these entertainment leaders are taking a different approach: streaming. Some of the hottest companies right now are Netflix, Disney, Hulu, and even Apple coming to the market.

With so many new streaming services launching what’s the one thing all these platforms will need? CONTENT!

As of February 2019, Netflix has 139 million subscribers. And they (along with all of these other streaming services) have and will be spending BIG MONEY for content.

LATEST FROM FEARLESS FILMS | Fearless Films, Inc. (FERL) Announces Acquisition of The Great Chameleon

Right Now streaming services like Netflix Inc (NASDAQ: NFLX) are spending billions of dollars on original content. According to Media Post:

“Netflix’s 2019 costs to buy, produce and license content will be $15 billion — up from $12 billion in 2018. 2019 marketing costs are pegged at $2.9 billion.”

According to a recent article that was published on The Motley Fool, the billions Netflix is spending on original content is just a small fraction of what streaming services as a whole will spend in 2019.

The article discusses how it will be a “pricey battle” for original content with some estimates putting stating that streaming services could spend approximately $40 billion on original content.

Independent Production Companies like Fearless Films (FERL) Have the Opportunity to Capitalize From This $40 Billion Dollar Content Gold Rush!

As per their latest press release Fearless Films (FERL) is the parent company of its wholly-owned subsidiary Fearless Films Inc. (Canada). Fearless Canada is an independent full-service production company founded by award-winning actor, producer Victor Altomare along with award-winning writer and director Goran Kalezic, Fearless Canada produces top quality entertainment with an edge.

Fearless Films (FERL) is an independent full-service production company! This is the exact type of company that can benefit from what could become one of the biggest cash grabs in entertainment history and here’s why…

You’ve likely heard of the big production houses:

- Warner Bros; owned by Time Warner which was purchased by AT&T (T) For $85 billion

- DreamWorks; acquired by NBC, now NBC Comcast (CMCSA), for $3.8 Billion

- Red Crown Productions; a private company that does big production deals with Netflix

It isn’t just Netflix who’s flexing billions in content budgets, Apple, Amazon, Disney, NBC, Roku – the list goes on. These are massive entertainment distributors who are now fighting for one thing… Where you spend your waking hours streaming entertainment.

Connect The Dots

Behind the billions, these streaming companies are spending are production houses ready to delivery quality titles, series, and more, BUT… There’s a big problem

Either these companies are private or they’re wrapped in such large industry conglomerates like NBC/Comcast where direct exposure to this pending boom is just a fraction of what it could be.

Such an Obvious Opportunity In The Sector, Fearless Films (FERL) is Looking to Take Advantage of this $40 Billion Dollar Content Gold Rush!

Fearless Films (FERL) has built itself upon a team of seasoned, well-established industry veterans.

Fearless Films (FERL) management has built a solid track-record, its co-founders have starred in, written, directed and produced a number of films dating back to the early ‘90s! The company’s subsidiary, Fearless Canada was founded by award-winning actor, producer Victor Altomare along with award-winning writer and director Goran Kalezic.

Years of experience and industry insight places Fearless Films (FERL) at a clear advantage when building its entertainment content portfolio that will be pitched to streaming companies.

On October 16, 2019, Fearless Films (FERL) entered into a Letter of Intent with company founder Victor Altomare to acquire the rights to up to twelve movies from a library held by Victor Altomare. Among the films being considered for acquisition are:

- The Lunatic

- Bag the Wolf

- The Great Chameleon

If you haven’t heard of these films, that’s quite alright and here’s why. Many of the streaming services with original content want to find entertainment that can be mass distributed by them first.

Ever hear of Lilyhammer? If you’re an avid Netflix and “Chill-er”, you know that the streaming giant picked up the first season to test the waters of this “not so mainstream” mob-based show.

What followed was almost cult-like. Lilyhammer was promoted as “the first time Netflix offered exclusive content.” The series went on to see 3 full seasons. Throughout the 3 season run of Lilyhammer Netflix was not the company behind the series, the just owned the exclusive licensing, a company called NRK owned it.

Starting To Make Some Sense?

What if you were able to have eyes on NRK as it struck a deal with Netflix and its show ultimately set the tone for “exclusive content”?

Right now, Fearless Films (FERL) is putting the pieces in place to amass an entertainment offering while bringing on notable names in the industry, and it’s happening at the exact moment streaming companies are ramping up their spends for original content.

Jeffrey Cole, a Research Professor at the USC Annenberg School for Communication and Journalism, and Director of USC’s Center for the Digital Future has been following the trends of content streaming services for a while. When it came to Netflix, he suspects the service could charge even more.

“It must drive [Netflix founder and CEO] Reed Hastings crazy that a dozen years ago in the red-envelope days, he gave you five DVDs at a time and unlimited streaming for $16 a month. Now he’s giving you not just five theatrical films at a time but dozens or hundreds plus massive amounts of old television shows and $12 billion worth of originals for $9 or $13 or $16 a month.”

And what about the “new guys” on the block like Apple? Jeffrey Cole explains how important and how much money the tech giant will be spending on entertainment alone,“I think entertainment’s going to become a key element of Apple’s business. For them, spending $2 billion on [original content] is just dabbling. If they like what they see, I think they’ll have a $10 billion budget.”

Is this starting to make sense?

Meet The Fearless Films (FERL) Management, Team

Fearless Films (FERL) has a management team is comprised of experienced, entertainment industry veterans.

Dennis dos Santos

President, CEO and Director of Fearless Films

Mr. dos Santos brings more than 25 years of management, capital markets and engineering experience to the position. Dennis has extensive capital markets experience as a ranked analyst for a number of brokerage firms, including RBC Capital Markets. He held the role of Head of Research at Northern Securities where he led the firm’s expansion of its coverage and banking activities within the resources and other sectors. Prior to his decade-long investment banking career, Dennis spent more than 10 years as a practicing Engineer for various companies, including 7 years at CP Rail. In addition to Fearless Films, Mr. dos Santos served as Chief Financial Officer and Director of Reddwerks Corp (Austin, TX) from 2013 to 2015. Reddwerks was acquired in December of 2015.

Dennis is well recognized for his financial, operational and technology skills and his ability to solve complex business issues that may impede the progress of the company. He has helped companies both large and small to raise capital from investors, having been part of more than 100 transactions with sizes ranging from $1 million to $750 million. Dennis has an undergraduate degree in Engineering (Concordia University, Montreal) and an MBA from the University of Pittsburgh (Pittsburgh, PA).

Ann Gerard

Member of the Board of Directors

Ms. Gerrard has been a Principal of Essentials of Health 15 and Business Management since 2000. As Principal, Ms. Gerrard provides Consulting Services with the aim of building partnerships and mutually beneficial business opportunities between entrepreneurs and similar companies. She also provides Project Management oversight, third party corporate facilitation and motivational team building, training and development, and procurement of financial investments. Ms. Gerrard was previously on the board of directors for Global Crawford & company which traded on the NASDAQ under CRD.A and CRD.B. She is currently affiliated with World Accord International Development Agency.

Eugene Gelsomino

Director of Fearless Films

Since 2016 he has acted as managing partner at Church Aperitivo Bar in Toronto, Ontario. Mr. Gelsomino’s main focus is on creating partnerships and marketing strategies to generate and drive business as well as to facilitate the booking of private and corporate functions. From 2013 to the present, he has been co-producer with Fearless Films, responsible for ensuring that projects stay on their production schedules and within budget. He is also responsible for post-production efforts including arranging and selling film distribution rights.

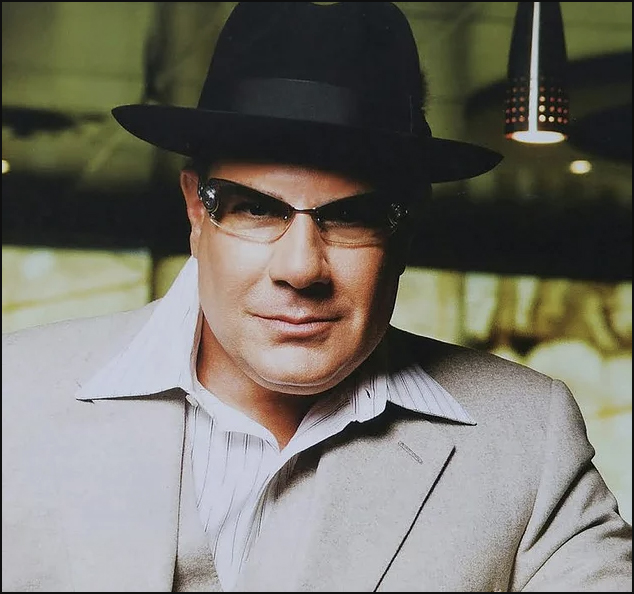

Victor Altomare

Co-Founder of Fearless Films (Canada)

He is the President/CEO of the operating subsidiary Fearless Films (Canada). Victor Altomare is an actor and producer, known for The Great Chameleon, Get the Sucker Back, Graveyard Story, the Last King and Bag the Wolf. Mr. Altomare studied acting at the Academy of Canadian Cinema & Television in Toronto before studying under Hollywood director Tom Logan. Mr. Altomare has been involved in more than 50 productions, including more than 10 films whereby he was the production lead. During his 25-year acting career, Victor has worked with acclaimed Stars such as Stacy Keach, Robert Davi, and Nick Mancuso.

RECENT Fearless Films (FERL) NEWS:

[10/16/2019]

Fearless Films Inc. (FERL) Enters into Agreement to Acquire Film Library from Founder

5 Key Points on Fearless Films (FERL)

- Fearless Films (FERL) is operating in the global video streaming market which is expected to reach a value of USD $124.57 billion by 2025 according to Grand View Research & providers will need to up their spending to offer new, diverse & original entertainment options for their customers.

- Companies like Netflix, Amazon, Hulu, etc… are spending upwards of $40 billion towards new original content, creating massive opportunities for companies like Fearless Films (FERL) to meet the demand of these industry powerhouses.

- The latest agreement with Fearless Films (FERL) Co-Founder could put assets that could be licensed immediately under the control of the company just as Apple, Disney, NBC and others launch their new streaming services.

- Fearless Films (FERL) has an experienced and successful management team that will help to further expand its product offerings.

- The demand for new & original streaming content from quality production companies is on the rise. As more companies release their streaming services more and more content will be needed. Companies like Fearless Films (FERL) have a real chance to claim their piece of the “$40 Billion Dollar Content Gold Rush!”

Get Your Free In-Depth Report on Fearless Films (FERL)!

Get the Company’s Latest Press Releases Delivered Right to Your Inbox As Well As Other Alerts On Public Companies!

Disclaimer:

Pursuant to an agreement between Midam Ventures LLC and Fearless Films Inc. (FERL), Midam has been paid $144,980 by Fearless Films Inc. (FERL) for a period from October 1, 2019 to November 17, 2019 and has been extended to January 31, 2020. We may buy or sell additional shares of Fearless Films Inc. (FERL) in the open market at any time, including before, during or after the Website and Information, to provide public dissemination of favorable Information about Fearless Films Inc. (FERL). Click Here For Full Disclaimer.

Sources:

https://www.reuters.com/brandfeatures/venture-capital/article?id=84296

https://www.grandviewresearch.com/press-release/global-video-streaming-market

https://www.engadget.com/2017/03/22/netflixs-big-budget-death-note-remake-lands-on-august-25th/

https://finance.yahoo.com/news/fearless-films-inc-enters-agreement-220500111.html

https://en.wikipedia.org/wiki/Lilyhammer

https://www.pcmag.com/feature/367417/disney-hbo-max-the-new-streaming-giants-explained/1

1 comment

This companies has on top in market https://tinyurl.com/yy39vo98