Anyone with several brain cells to spare and a connection to the internet should know that the last couple of weeks have included five people, on separate occasions, announcing their intentions to run for the Democratic nomination in the upcoming 2020 presidential election. Before we begin to analyze what’s going down, it should be said that if any of you are posting on social media, saying something along the lines of “insert-candidate name 2020,” you should stop.

We are more than one year out from the Iowa caucus and many of the candidates occupying the

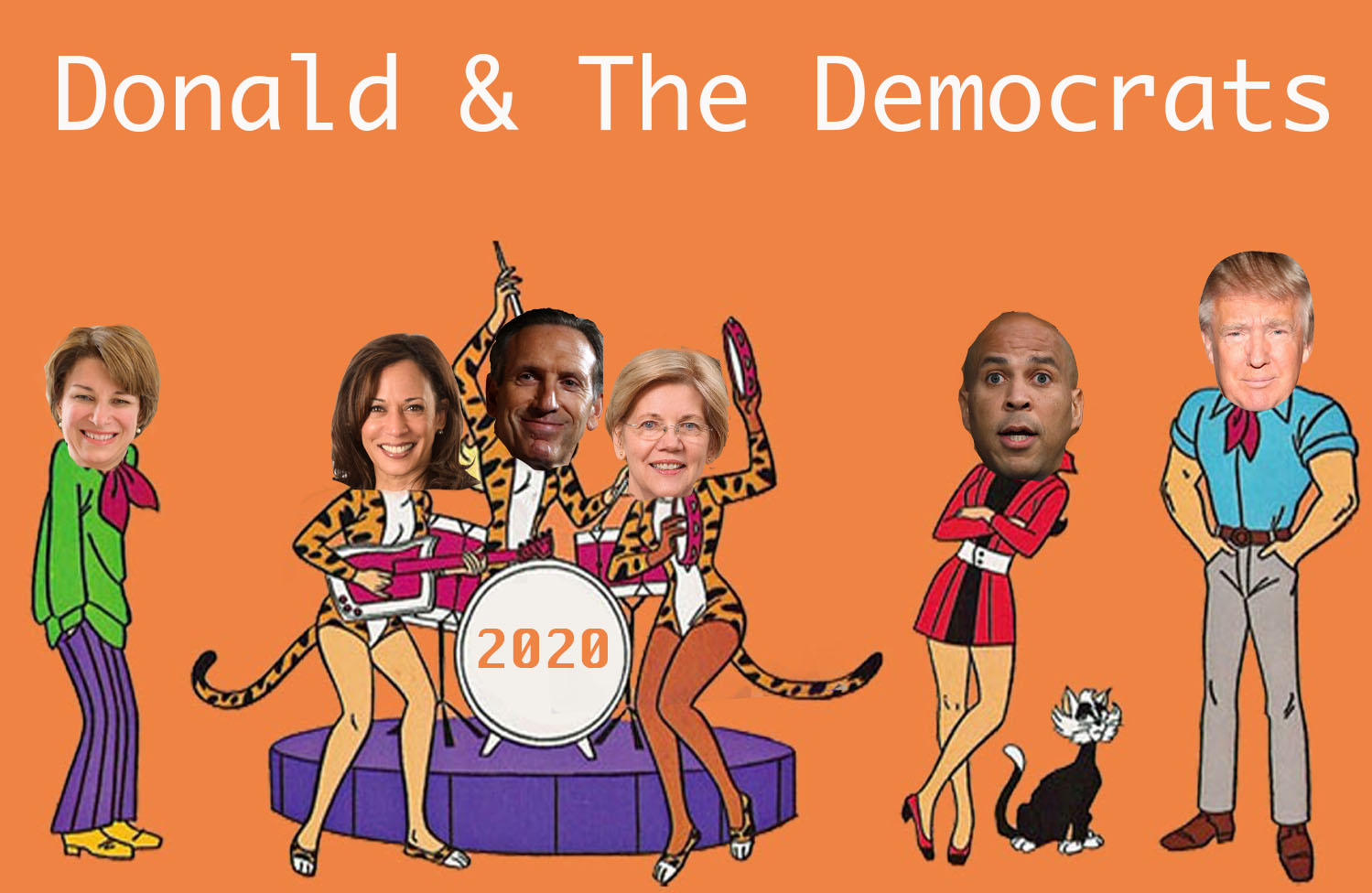

President Trump announced plans for running for reelection within weeks of his inauguration. While some may call this premature, these individuals largely underestimated our president. According to my sub-par mathematical skills, President Trump has a little under two years left of his time as president, but he has made it quite clear he has no intention of leaving.

The recent onslaught of Democratic candidates demonstrates just how intent Democrats are on reclaiming the throne in 2020. In a recent Monmouth University poll, when asked to choose between “a Democrat you agree with on most issues but would have a hard time beating Donald Trump,” or “a Democrat you do not agree with on most issues but would be a stronger candidate against Donald Trump,” Democrats preferred the latter by nearly 60%.

While I have every intention of speaking on the potential

Earlier this month, on the first day of February to be exact, New Jersey Sen. Cory Booker announced that he will be running in the Democratic primary with hopes of landing a seat in the big chair. As the former mayor of Newark, New Jersey, Booker, 49, has spent much of his career fighting to thwart criminal injustices in our societal framework as well as work to reduce the racial/economic disparities which plague our nation.

“We are better when we help each other. I believe that we can build a country where no one is forgotten, no one is left behind; where parents can put food on the table; where there are good paying jobs with good benefits invert neighborhood; where our criminal justice system keeps us safe, instead of juggling more children into cages and coffins…”

–Sen. Cory Booker (D-NJ)

Several weeks earlier, Sen. Kamala Harris (D-CA) announced her intention to run for the nomination as well. The former California Attorney General turned Junior Senator made her plans public on Martin Luther King Day, a holiday that many associates with federal offices being closed, but others know as a day to reflect on a man who was assassinated for advocating for the civil rights of all living people. Harris is not, by typical measures, representative of what many Americans associate with a typical presidential candidate, namely because she isn’t an older white man.

In addition to Sen. Harris and Sen. Booker, we know that Sen. Elizabeth Warren will be gunning for the Democratic slot, as well as former Starbucks CEO Howard Schultz.

As we’ve seen from the statistics shared above, Democratic voters simply want an apt replacement for Donald Trump, so who will they choose in November 2020. According to several political scientists, including The Week’s Joel Mathis, when “parties pick their presidential candidates more with their heads than their hearts — when they pick a candidate they want to win — they usually end up losing.” It becomes less of a question of which candidate has the potential to make it, but more who we want in power, and then we shall make it so.

I speak for the millennial generation when I say that our words tragically speak louder than our actions. We are champions of the moment, but if you ask us to follow through, we fall short fairly often. In terms of choosing our nation’s next president, a Democratic candidate will have a shot if, and only if, voter turnout improves dramatically.