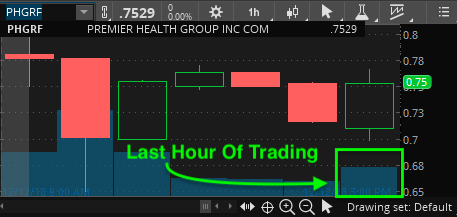

We’ve been monitoring the progress of Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) for several weeks now and it managed to hit fresh highs of $0.80 on strong, opening bell momentum on December 12. Keep in mind that within just the last 4 days, we’ve seen this jump from lows of $0.57 to December 12 highs of $0.80; a move of 40%. We mention this because Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) pulled back but what has happened since then is what we’re looking at right now.

Instead of falling apart, Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) held a level that was once its previous high that we saw early this quarter. Furthermore, it didn’t just hold this level, it has since bounced back BIG from that level. By the closing bell, Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) ran back to close out the day at $0.75 to make a rebound of 15% from its lows.

Keep in mind that EVERY DAY this week, the afternoon session has been VERY active, which is why we said above that we’re looking to the December 13th session to see what happens next.

For three consecutive days, the momentum we saw during the second half of the day has been nothing short of impressive. In fact on December 12th, Premier pulled back from $0.76 to $0.71. But once again, during the last hour of the day, Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) saw bullish action and a push back to $0.75 by the closing bell:

This was the same trend we saw for two days prior and everyone watching watched how a strong close ended up continuing into a strong open the next day. Can we see this on “day four”?

Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) & Its Opportunity Within Canada’s Medical Marketplace

This latest move has been on the heels of Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI)‘s latest announcement where they have just signed a binding Letter of Intent to acquire a Vancouver, British Columbia based pharmacy. As far as timing is concerned, the expected closing isn’t years away; the Company expects the acquisition to close in or about Q1-19.

For the fiscal year 2017/18, the pharmacy has revenues of approximately $1MM and Adjusted EBITDA of about 30%.

“We are excited for this opportunity to acquire our first pharmacy, and thereafter being able to prepare and deliver prescription and non-prescription pharmaceuticals and other health products to patients. In doing so, the pharmacist will play an integral role in our team-based patient-centric model,” said Dr. Essam Hamza, CEO of Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI)

The pharmacy industry in Canada could be on the cusp of big potential now that cannabis is legal. In fact, pharmacies like Shoppers Drug Mart, for example, have been granted a license to sell medical marijuana online and we’re sure they won’t be the only ones.

Health Canada’s list of authorized cannabis sellers and producers has been updated to reflect that the pharmacy can sell dried and fresh cannabis, as well as plants, seeds, and oil.

The spectrum of offerings has just been widened and those companies getting a foot in the Canadian pharmacy market right now could have the upper hand as this market continues to expand.

Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) not only has a large patient pool and a “foot in the door” with this LOI, but they’ve also got telehealth technology in place to stay at the forefront of this new market directive! Just look at what the MAJOR cannabis companies are starting to do.

Aurora Cannabis, for example, just purchased Farmacias Magistrales in Mexico…they’re going after pharmacies to grow! Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) is already hot on this trail while also having MORE PATIENTS under its umbrella than some of the largest cannabis companies in the industry.

When we talk about timing and connecting the dots, this is what we’re talking about. With Premier Health Group Inc., (OTC: PHGRF) (CSE: PHGI) managing to hit new highs during the last three sessions, could the second half of the week have more momentum in store?

Click Here To Read The Full Report On Premier Health Group (OTC: PHGRF) (CSE: PHGI)

DISCLAIMER: Pursuant to an agreement between MIDAM VENTURES, LLC and Premier Health Group Inc. we were hired for a period from 10/1/2018 – 4/1/2019 to publicly disseminate information about Premier Health Group Inc. including on the Website and other media including Facebook and Twitter. We were paid $300,000 ( CASH) for & were paid “500,000” shares of restricted common shares (as of 1/2/2019). We own zero shares of Premier Health Group Inc., which we purchased in the open market. Once the (6) Six-month restriction is complete on 4/1/2019 we plan to sell the “500,000” shares of Premier Health Group Inc. that we hold currently in restricted form during the time the Website and/or Facebook and Twitter Information recommends that investors or visitors to the website purchase without further notice to you. We may buy or sell additional shares of Premier Health Group Inc. in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information. Click here for full disclaimer..