Liberty Defense (SCAN.V) (LDDFF) Is Positioning To Disrupt A Multi-Billion Dollar Industry

There have been more mass shootings this year in the United States than there have been days in the year. Over 330 mass shootings [1], to be exact. This is becoming a huge issue that is costing precious lives and could see billions of dollars spent to fix this situation.

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) has a technology that could disrupt this multi-billion-dollar industry for the better. (click play below)

Global spending on security solutions is projected to reach $7.4 billion in 2019 and increase to over $11.3 billion by 2025 with a CAGR of 8.2%.

The urban Security explosives and Weapons Detection market is slated to grow to nearly $7.5 billion by 2025 and is forecast to see consistent growth for the next several years [2].

For investors, it could signal big opportunities but with so many large companies targeting surveillance systems and weapon detection devices as a “go-to”!

Liberty Defense (SCAN.V) (LDDFF) Is Positioning To Change The Face Of Threat Detection For Good!

The truth of the matter is that mass shootings now happen more than once a day in the US and as we’ve come to find, there’s no real way to stop these attacks after an attacker enters a space. This is where the real opportunity is: stopping an attack before someone even enters a vulnerable space.

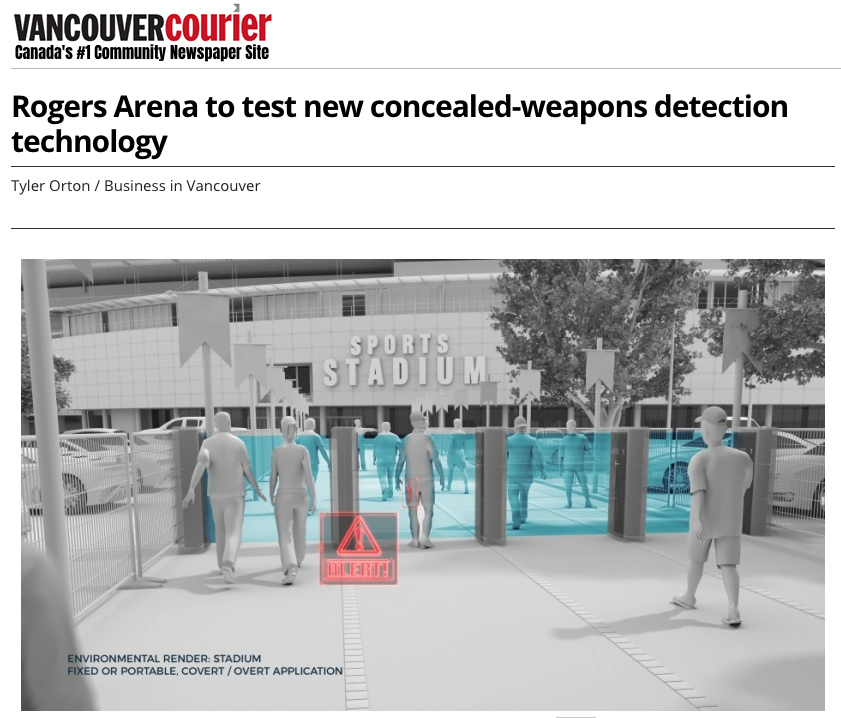

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) plans to do that using HEXWAVE, a next-generation high-tech security scanning system that will use advanced, low-power radar, 3D-imaging, and Artificial Intelligence (AI) to screen people at public gatherings such as sports games, unobtrusively. (click play below)

You may be thinking that the processes and screening technology that you see in airports can achieve the same thing in our communities. But we’re talking about urban detection; where high people traffic flow and attempts to provide airport-like screening processes can be extremely disruptive to business activity because of security entry delays. There also needs to be a way to detect other potential mass attack weapons including explosives, pyrotechnics, and other non-metallic threats.

Utilizing a new disruptive technology under an exclusive global license from MIT (Massachusetts Institute of Technology), Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) is developing HEXWAVE.

Liberty Defense (SCAN.V) (LDDFF)’s HEXWAVE Apart From The Competition?

HEXWAVE is the first practical application of real-time, 3D imaging. It uses low-power radar energy, which helps generate real-time 3D images to detect weapons such as guns, knives, explosives, and other threats through clothing, backpacks and hand baggage. This product creates, real-time concealed threat images which are assessed using deep learning and AI. Thus alerting security regarding the decision response hierarchy.

Liberty Defense (SCAN.V) (LDDFF) will be Testing In Real Life Scenarios!

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) has already inked several Memorandums of Understanding for beta testing of HEXWAVE, which is expected to start in early 2020! This initially included Vancouver Area Limited Partnership’s Rogers Arena, and Sleiman Enterprises, one of Florida’s largest real estate companies developing and managing malls, hotels, and shopping centers.

And the company is already taking proper steps to confirm easy access for government agencies. The company announced its collaboration with TÜV SÜD America Inc. (TÜV SÜD). This efforts is to ensure the company’s HEXWAVE product will meet Wireless, EMC, and Safety standards for the Federal Communications Commission (FCC), Industry Canada (IC), and European Conformity (CE) certifications.

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) has created a strong pipeline of premier potential customers.

The opportunity to test with Vancouver Arena Limited Partnership in or around Roger’s Arena could present a big opportunity to prove HEXWAVE and the technology. The arena itself has hosted over 25 million fans and is home to myriad events.

Liberty Secures Its Place with NVIDIA’s AI Program

Beta testing with such big names isn’t an easy feat but Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) has taken things a step even further. The company has been accepted into NVIDIA’s AI program built specifically to accelerate growth for AI technology.

For a company of this size to earn such a position speaks volumes about the potential that HEXWAVE could hold. The virtual accelerator program provides tools, technology, and expertise to help Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) during the stages of product development, prototyping, and deployment. It also offers training from the NVIDIA DL institute, hardware discounts, and grants.

Liberty Defense (SCAN.V) (LDDFF)’s Opportunities Ahead For Detection

Emerging companies in this sector are poised for increased opportunities and growth with the political spotlight looking at gun control and public safety. This technology product could revolutionize the standards of security and set Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) up to become a market leader taking a seat at the table with companies like major government contractor L3 Technologies (LLL) who provides detection and security systems for U.S. Department of Defense, Homeland Security. Similarly, it could position itself to directly take on tech innovators like Harris Corp. (HRS), which supports the government and commercial customers in over 100 countries.

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) could provide investors with the opportunity to take part in this rapidly growing market early!

“Currently, there is a significant gap that must be addressed in urban security threat defense. HEXWAVE provides a wider perimeter for early detection beyond just the point solution typically positioned at an entrance of a facility. This essential layer will enable security measures to be proactively deployed to detect a threat before it transitions to an attack condition. Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) can fill this gap.”

Bill Riker, CEO of Liberty Defense (TSX: SCAN.V) (OTC: LDDFF).

Liberty Defense (SCAN.V) (LDDFF)’s All-Star Management

Advancement from the operational to strategic level is a crucial undertaking that all companies must undergo in pursuit of success. The executive leadership team at Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) has the necessary insight to achieve profitable growth and maintain operational systems.

Bart Smudde, Chief Technology Officer

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) chief technology officer, Bart Smudde, brings over 30 years of experience to the table in designing, testing and manufacturing electronics products in several markets including military and medical. Smudde has managed engineering teams for companies including Graco, Landis+Gyr, SignalONE Safety, and Panasonic.

Ron Solanki, VP Operations of U.S, Subsidiary, Liberty Defense Technologies Inc.

In early May, 2019, Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) brought on Ron Solanki as VP Operations of its US Subsidiary. Mr. Solanki has held leadership positions with major multi-national global electronics corporations such as Motorola, Panasonic, Flextronics and Hisense. With over 30 years of experience delivering results in high-tech company operations, he has helped build businesses around strategic business management and development, R&D, manufacturing, supply chain, and legal affairs. He has also served on international boards of directors and business & technology advisory boards.

Jordan Eck, VP of Implementation and Service

Jordan Eck is a senior executive with 15 years of experience building and leading skilled technical resource teams across national and international territories. He has an established record of successful sales and operational initiatives with an emphasis on corporate-wide strategic and tactile results targeting organizational alignment, operational efficiency, high-energy/performance culture, and customer experience. With over 2000+ successful projects in his portfolio, Jordan has lead initiatives for stakeholders including the U.S. Government, U.S. Military, DISA, and various fortune 500 organizations. Jordan is a trained system engineer for multiple forms of electronic, physical, and network security platforms. Jordan holds advanced degrees in Project Management, Corporate Finance, and Organizational Leadership.

Robert (Bob) Falk, VP of Sales and Business Development

Mr. Falk has over 20 years of experience in the detection and security inspection industries as well as in business development and sales. Mr. Falk served as Evolv Technology’s Director of International Sales, and has also worked as an independent aviation security consultant for a number of U.S. and European companies including Gilardoni, AS&E and Surescan.

Key Board Appointments Can Secure Additional Opportunities

While management is key, so are the people on its board and advisors. These members can, and in the case of Liberty Defense (TSX: SCAN.V) (OTC: LDDFF), HAVE led the company to even more opportunities and market insight. It doesn’t take long to connect the dots:

- Jeremy Morton, Executive Chairman, Corporate Strategy Officer of Minimax Viking. Previously President of Stanley Access Technologies. Held senior roles at Stanley Local Security, CNL Software, Ingersoll Rand, and Schneider Electric.

- John McCoach, Lead Independent Director, Past President of the TSXV (9 years). Board member of the Capital Markets Authority Implementation Organization.

- Corby Marshall, a

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF)’s advisory council boasts a roster of several other notable individuals including:

- Francesco Aquilini, NHL Governor

- Victor Montagliani, VP of FIFA

- Anthony T. Sleiman, CEO and President of Sleiman Enterprises, Inc., one of Florida’s largest privately held real estate companies.

- Craig Peters, one of the top CBRE brokers in the Western US.

- Al Grasso, former President and CEO of The MITRE Corporation; and

- Mit Shah, founder and CEO of Noble Investment Group.

Can You Detect A Winner?

We live in a world where threats to our safety, both large and small, have impacted the way we live. Increased security measures are being taken in several aspects of daily life such as entering a school or even a baseball game. Worse off, not all current security measures are stopping these threats before they happen.

Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) is working on a solution to combat these issues head-on through the implementation of its HEXWAVE product. As we move towards the future, it important for investors to pay attention to his sector and Liberty Defense (TSX: SCAN.V) (OTC: LDDFF) could have the key to disrupting a multi-billion dollar industry!

Disclaimer: Pursuant to an agreement between MIDAM VENTURES, LLC and Liberty Defense Holdings Inc. Midam was hired for a period from 06/1/2019 – 9/30/2019 to publicly disseminate information about Liberty Defense Holdings Inc. including on the Website and other media including Facebook and Twitter. We were paid $250,000 (CASH) for & were paid “0” shares of restricted common shares. We were paid $75,000 (CASH) by Liberty Defense Holdings AND HAVE EXTENDED coverage for a period from 11/1/2019 – 11/30/2019. We may buy or sell additional shares of Liberty Defense Holdings Inc. in the open market at any time, including before, during or after the Website and Information, provide public dissemination of favorable Information. For previous compensation see our FULL DISCLAIMER HERE

End Notes:

[1] https://www.massshootingtracker.org/[2] Homeland Security Research Corp (HSRC) for Explosives & Weapons Detection Systems Technologies & Industry 2018-2025

[3] https://www.marketsandmarkets.com/PressReleases/threat-detection-system.asp

2 comments

Reminds me that sometimes…..those who pose solutions are the ones causing the problem. One of the basic tenants of crisis management, right after never letting a good crisis going to waste: create the problem, then offer the solution.

“I am a regular reader of your website and I actually appreciate your content. The article has genuinely appealed to my interest. I’m going to bookmark your web page and keep an eye for new details. I was actually looking for some good blogs to understand finances and I found yours. I like your high quality information and your posting abilities. Keep doing it. “