There’s no denying that the vast majority of multi-billion dollar mergers and acquisitions have been in the biotech sector. Mainly it has been companies that offer novel immune therapies that have caught the attention. This is a big reason why the sector could become an even bigger focus for the second half of 2019.

For this reason, we’re taking a closer look at 4 biotechnology penny stocks to watch this month:

Biotech Penny Stock #1: GT Biopharma Inc (GTBP)

GT Biopharma Inc (GTBP) is a biopharmaceutical company that places heavy emphasis on immuno-oncology and central nervous system treatments. They currently have 7 drugs in their company pipeline and are continuously seeking more. GT Bio’s immune-oncology treatments are formed by combining scFv constructs with antibody-drug linkers.

The treatment getting the most spotlight as of late is the company’s GTB-1550. The therapy is a bispecific drug conjugate therapy to treat diseases like Non-Hodgkin’s Lymphoma and Leukemia. The spotlight on this treatment (antibody drug conjugates or “ADC’s”) is partly coming from Bloomberg where they stated drug conjugate therapy could replace traditional chemotherapy.

Bloomberg pointed out that the fervor over ADCs is such that AstraZeneca Plc in March agreed to pay as much as $6.9 billion to jointly develop DS-8201 with Japan’s Daiichi Sankyo Co., the British drugmaker’s biggest deal in more than a decade.

[Free Report] Big Investments Are Signaling The Green Light For A ‘Hot Market’ With Cancer-Fighting Stocks

Anthony Cataldo (CEO GT Biopharma, Inc.) said, “The Bloomberg article points out the excitement that big pharma is now realizing as the potential for ADC’s as a realistic alternative to Chemo Therapies. What differentiates our ADC Bispecific GTB-1550, is the ability for our drug to hit multiple target sites of B-cell malignancies as opposed to the one target ADC’s represented in the Bloomberg article. We are happy to see the attention of the large pharmaceuticals moving in this direction.”

In addition to Bloomberg, GTB-1550 recently showed strong results from their Phase I-II trials. Anthony Cataldo, the Chairman and CEO of GT Bio stated, “GTB-1550 has shown positive results in its two Phase I-II clinical trials in advanced cancer patients who have failed all other therapies, and we are now planning to proceed with a Phase II clinical trial.”

Biotech Penny Stock #2: Onconova Therapeutics Inc. (ONTX)

Onconova Therapeutics Inc. (ONTX) is a company that is zeroed in on developing treatments for people with myelodysplastic syndromes (MDS). This disease caused bone marrow failure which can then result in acute myeloid leukemia. Onconova is trying to take this disease, that has little to no previous medical advancements, and find an effective cure.

Currently, Oncova’s lead treatment is called Rigosertib. At the moment, the drug is currently in its Phase 3 trial to treat high-risk MDS. Rigosertib was also awarded Orphan Designation for MDS by the US, Japan, and Europe. If their Phase 3 trial goes well, this could definitely be a biotech penny stock to watch.

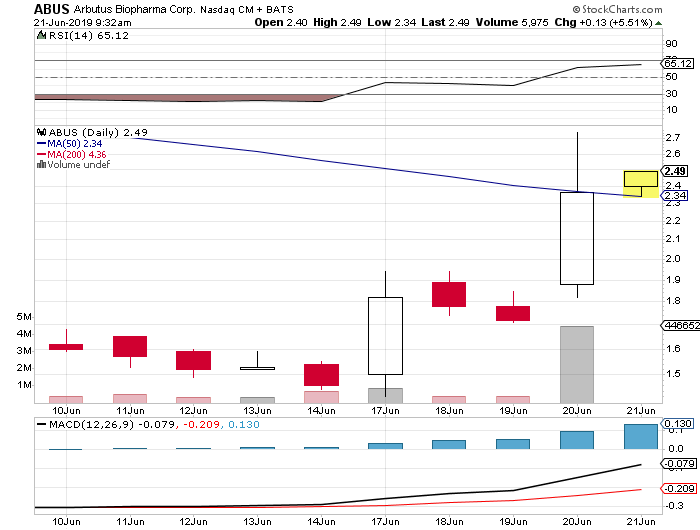

Biotech Penny Stock #3: Arbutus Biopharma Corporation (ABUS)

Arbutus Biopharma Corporation (ABUS) is creating treatments to help patients who have chronic hepatitis B infection. Estimations show that almost 300 million people have HBV which gives Arbutus a large potential market. Arbutus’ recent news has brought some significant volume and attention which could prove fruitful for future growth.

The company received clearance to initiate a clinical trial for their treatment, AB-729. Dr. Gaston Picchio, Chief Development Officer at Arbutus’s, stated, “The Phase 1a/1b clinical trial of AB-729 is expected to initiate shortly and will initially be evaluated in healthy volunteers followed by chronic hepatitis B patients in single ascending dose cohorts.”

Biotech Penny Stock #4: Palatin Technologies (PTN)

The recent excitement seems to have started in April after the company reported positive top-line results of its oral clinical study of PL-8177. The treatment is designed to address ulcerative colitis and other inflammatory bowel diseases.

“The main objective of the study was to demonstrate release of polymer-bound PL-8177 in the lower gastrointestinal tract after oral administration. Top line data showed favorable pharmacokinetics, and demonstrated PL-8177 was released in the lower gastrointestinal tract, supporting oral administration of PL-8177 using the delayed release polymer formulation.”

But ahead of a big FDA decision, shares of PTN stock are lower to start the June 21 session. On June 23rd, the application for Vyleesi (bremelanotide), a drug developed by Palatin and licensed to AMAG Pharmaceuticals (AMAG) will be up for review by the FDA as a New Drug.

Vyleesi is a novel melanocortin 4 receptor agonist under evaluation for restoring a natural sexual desire in premenopausal women with HSDD. Think of this like female Viagra. And like we asked in our previous article, will this become the sexiest biotech penny stock this month or will stock traders get blue balled?