As a kid, I wanted, more than anything, to have super powers. When I’d take my dogs for an evening walk, I would make sure that no one was watching me, channel all the strength I could and I would jump in an effort to fly. I’m well aware that this is both comical and ridiculous, but super heroes represented something more to me than beings with incredible abilities. Name any super hero and each and every one of them firmly believed in ridding the world of evil doers and bad guys so that we could live life to the fullest in peace. The hero archetype has existed for thousands of years, first appearing in greek mythology amidst tales of great heroes defeating terrible monsters threatening life as we knew it.

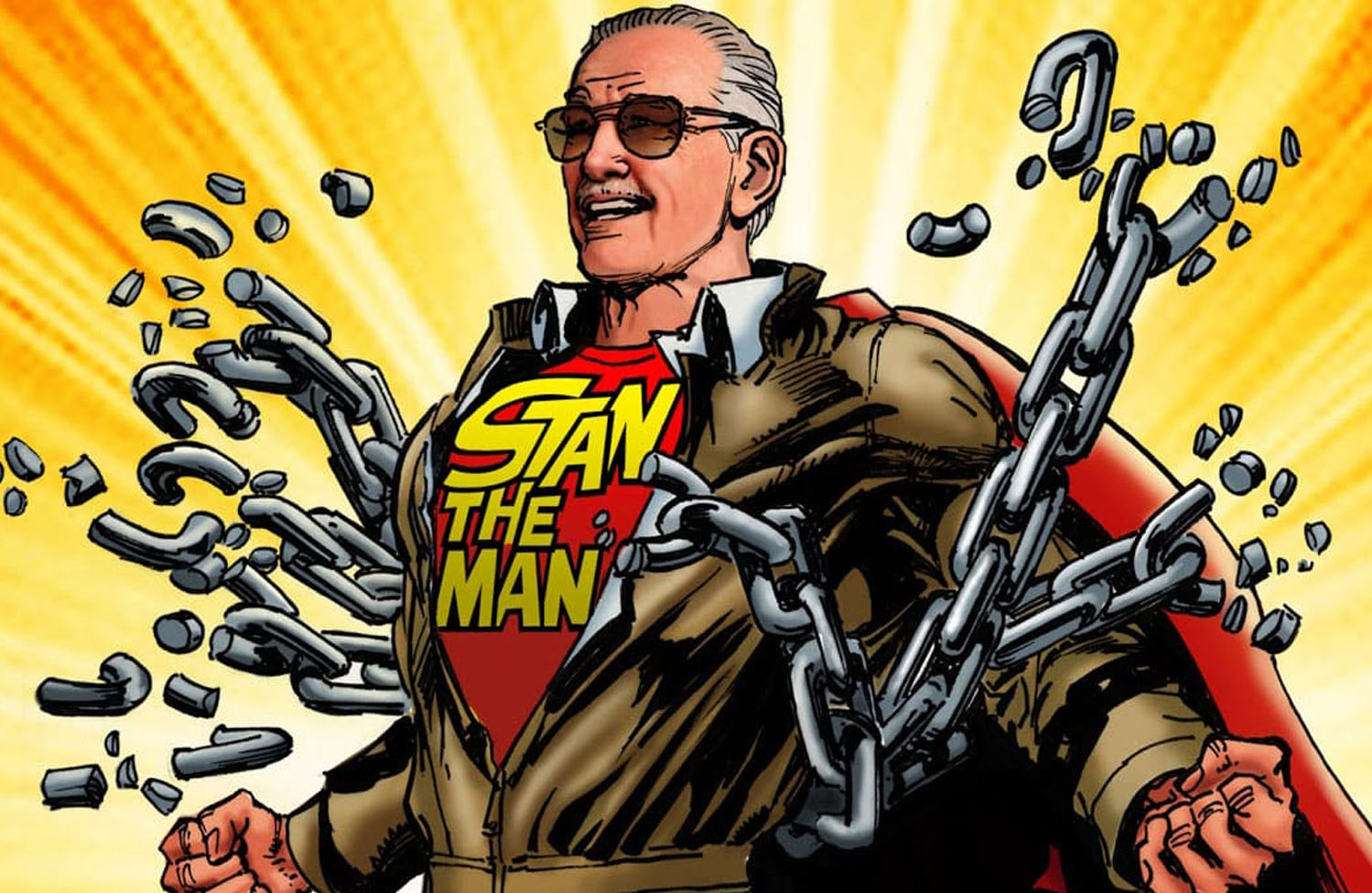

Stanley Martin Lieber, famously known as “Stan Lee,” believed in superheroes and knew the impact their stories had on people of all ages, colors, and creeds. It is with a heavy heart that I inform you that the mastermind behind Marvel Comics died today. TMZ reports that Lee had been sick for quite some time and passed away in the arms of loved ones at Cedars-Sinai Medical Center in Los Angeles, California.

Lee started his career in comics back in 1939, working as an assistant at the Timely Comics division of Pulp Magazine. In an interview many years later, Lee recounted that “in those days [the artists] dipped the pen in ink, so I had to make sure the inkwells were filled. I went down and got them their lunch, I did proofreading, I erased the pencil from the finished pages for them.” Suffice to say his beginnings were anything but lavish.

Some years later, Lee teamed up with Jack Kirby to create Marvel Comics, featuring the Fantastic Four as the first group featured in one of their comics. Lee and Kirby would go on to create the Hulk, Thor, Iron Man, X-Men, Spider-Man, and Captain America.

Stan Lee did much more than create perhaps the most prophetic alternate to our dismal reality. When Spider-Man defeated the Green Goblin, children felt empowered to stand up to schoolyard bullies. If Tony Stark, Iron-Man’s alter-ego, designed technology to save the world from a natural disaster, someone reading the comic in a third-world country was filled with hope that, maybe someday, they could help the world like Mr. Stark. Lee’s Marvel heroes showed us that we could be the person the world said we couldn’t, stand up for what we believed in, and, in our heart of hearts, feel truly super.

Wherever we end up when we pass, I hope Stan Lee is right there, being praised for inspiring generations of real-world heroes.

With great power comes great responsibility, and Stan Lee owned that privilege and created something truly remarkable.

May he rest easy as the most powerful superhero in the comic universe.