If there is one sector that has grown immensely strong over the past decade and a half, then it’s biotech. These biotech stocks and underlying companies have come up with highly innovative solutions to a range of diseases. Furthermore, it has been through the use of technology and knowledge of pharmaceuticals, which has added to the innovation.

As a consequence, the sector has grown considerably and a lot of investor capital has flooded into the sector. However, in order to make a return on investment, an investor needs to keep a close eye on the market and then make his investments after he has made a list of the biotech stocks to invest in. On that note, here is a look at 3 biotechnology stocks that proved to be winners recently.

Biotech Stock #1:

PharmaCyte Biotech

PharmaCyte Biotech (PMCB Stock Report) recently announced the appointment of David A. Judd to PharmaCyte’s Medical and Scientific Advisory Board. Mr. Judd has had over 30 years of experience in the research and development of cell culture materials and methods for the culturing various types of human cells. Judd also works at Grand Island Biotechnology Company and is involved in research, process development and cGMP production of biotechnology and cell therapy processes. This could make a perfect fit for him at PharmaCyte.

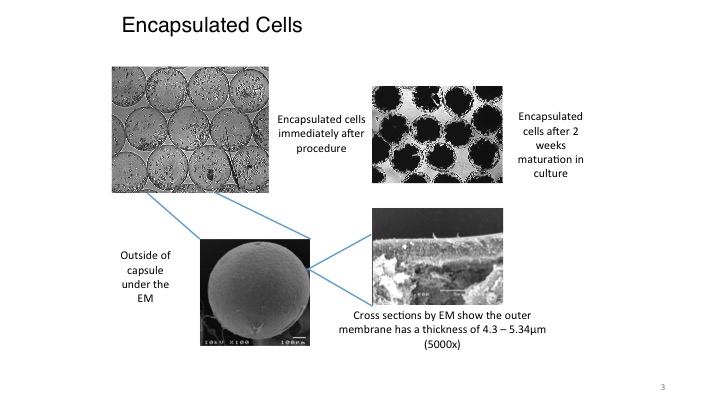

If you’re looking at PharmaCyte Biotech at this exact moment, you’re seeing it before the company begins clinical trials and just as it’s preparing to complete its Investigational New Drug Application for the FDA. Whether you’re new to biotech stocks or a seasoned vet, you should understand how important milestones like this are for a company. At this point, PharmaCyte is focused on developing targeted cellular therapies for cancer and diabetes using its signature live-cell encapsulation technology, Cell-in-a-Box.

Here’s why an open IND is key to PharmaCyte (PMCB) realizing a number of benefits that include:

- Beginning the formal arrangements required to conduct its clinical trial in LAPC.

- Working towards the major milestone of enrolling the first patient in its clinical trial.

- Publishing that the technology behind its LAPC treatment has passed the incredibly difficult FDA screening process and met all of the FDA’s regulatory requirements.

- Building global exposure of PharmaCyte’s Cell-in-a-Box® technology.

- Paving the way for the development of treatments for multiple diseases including diabetes and a host of solid tumors.

Biotech Stock #2:

Provention Bio

The next one to look at is Provention Bio Inc (PRVB Stock Report). The biotech stock has been on a hugely impressive rally this year so far. The biotech stock price has surged by as much as 550% in 2019. Why? The big trigger was the results of a National Institute of Health study into the PRV-031 medicine that was published last month.

The study found significant insight in the company’s PRV-031 medicine. If it’s administered over the course of two weeks, the onset of Type 1 diabetes can be delayed by as long as two years. This was found in patients who are at high risk.

Additionally, Provention had started a Phase 3 clinical study of the PRV-031 product back in April. That proved to be an important trigger as well. Enrollment for the Phase 2 study of its Crohn’s disease medicine PRV-6527 has also been concluded.

Biotech Stock #3:

ArQule

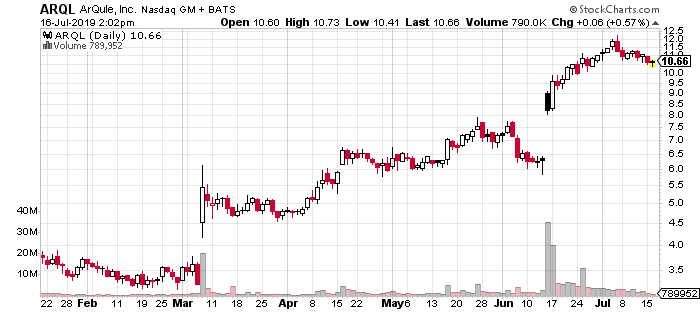

The other biotech stock to watch had an excellent run in June. The clinical-stage pharmaceutical firm ArQule, Inc. (ARQL Stock Report) stock jumped as much as 53% over the course of last month.

This was due to highly promising data from two clinical trials of its product ARQ 531. The trials showed that its medicine had an effect on cancer variants that affect the white blood cells. The biotech stock also managed to raise substantial capital through a private offering. Moreover, the stock is up 280% since the beginning of this year.